BANKRUPTCY FILINGS

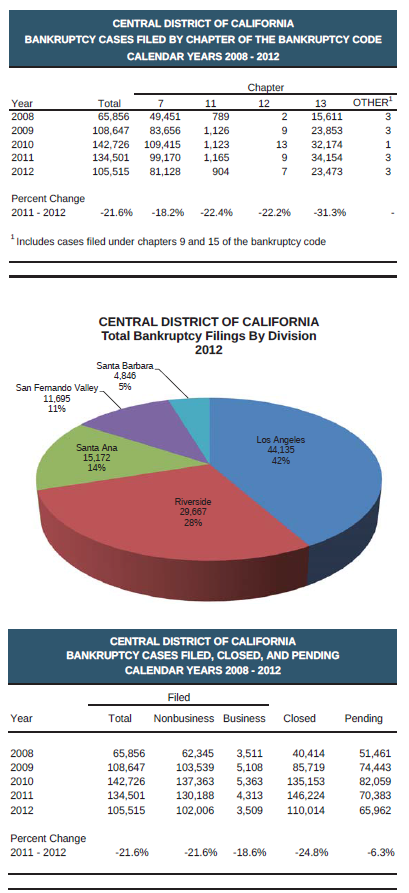

In 2012, the Central District of California again saw a

decrease in bankruptcy filings. A total of 105,515 individual

and business bankruptcy cases were filed in 2012, a 21.6

percent decrease from the 134,501 filings in 2011. Filings

for all chapters declined significantly.

In 2012, the Central District of California again saw a

decrease in bankruptcy filings. A total of 105,515 individual

and business bankruptcy cases were filed in 2012, a 21.6

percent decrease from the 134,501 filings in 2011. Filings

for all chapters declined significantly.

Chapter 7 filings decreased by 18.2 percent to 81,128 filings in 2012 and accounted for 76.9 percent of all petitions filed district-wide. Chapter 7 filings also accounted for 77.9 percent of all business filings and 76.9 percent of all nonbusiness filings in 2012.

Chapter 11 filings dropped 22.4 percent to 904. Chapter 11 cases, which typically require more judicial resources than cases that are filed under other chapters, accounted for approximately 1 percent of all petitions filed in 2012, consistent with the percentage of chapter 11 filings from 2011. Over 67 percent of chapter 11 petitions were business cases.

Chapter 13 filings decreased the most, falling 31.3 percent. A total of 23,473 chapter 13 petitions were filed in 2012. Chapter 13 petitions accounted for 22.2 percent of all filings in 2012, down from 25.4 percent in 2011. Chapter 13 petitions also accounted for 22.9 percent of all nonbusiness filings and 4.5 percent of all business filings in 2012.

The number of bankruptcy petitions closed by the Central District in 2012 dropped 24.8 percent to 110,014. Because terminations exceeded filings in 2012, there were 65,962 cases pending in December 2012, which was 6 percent less than the number of cases pending in December 2011.

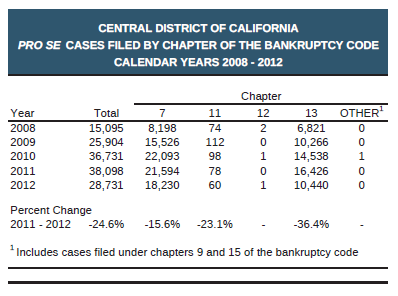

Although bankruptcy filings continued to decline for the second consecutive year, the Central District still averaged over 111,000 filings per year during the past five years, the highest average in the Court’s history. This was the fifth consecutive year the Central District led the nation in total bankruptcy filings.

According to the national filing data released by the Administrative Office of the United States Courts, the Central District of California received 85.2 percent more bankruptcy filings than the second largest district, the Northern District of Illinois. Additionally, the Central District of California led the nation with the highest total of chapters 7, 11, 13, business, and nonbusiness filings. Bankruptcy filings in the Central District of California account for nearly 9 percent of the nation’s filings.

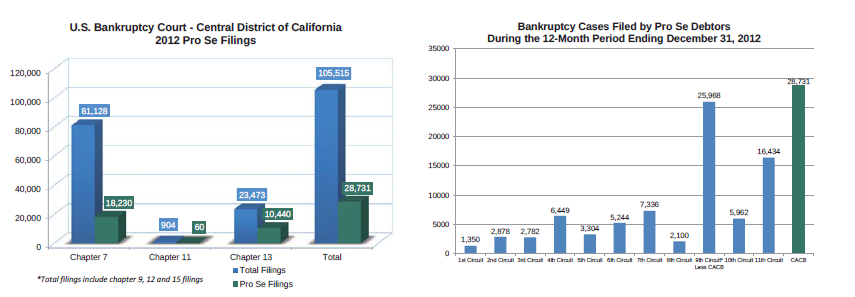

Pro Se Filings

The Central District of California led the nation in both the number and percentage of pro se filings in 2012. The Central District’s rate of pro se filings for the year was 27.2 percent, over three times the national average of 8.9 percent and 331 percent more than the next highest district, the Eastern District of California. The Central District handled over 26 percent of the entire nation’s pro se bankruptcy filings. The Central District alone handled more pro se filings than seven individual circuits. Its pro se filings exceeded those of all the combined districts which make up the entire First, Second, Third, Fourth, Fifth, Sixth, and Seventh Circuits. If the Central District were treated as a circuit, it would continue to lead the nation in total pro se filings.

Of the 105,515 bankruptcy cases filed in the district, 28,731 were pro se filings. Chapter 13 petitions had the highest pro se percentage with 44.5 percent, followed by chapter 7 petitions with 22.5 percent. Chapter 11 had the smallest percentage of pro se filings with 6.6 percent.

Adversary Proceedings

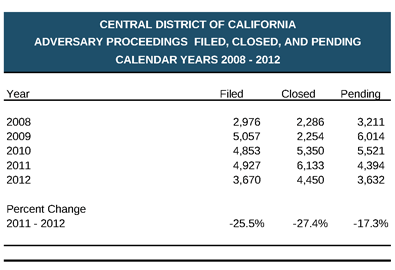

In 2012, adversary proceedings decreased 25.5 percent from 4,927 in 2011 to 3,670.

The number of adversary proceedings closed declined the most, with 4,450 cases closed in 2012, 27.4 percent lower than the 6,133 closed in 2011. Pending adversary proceedings fell 17.3 percent, from 4,394 in 2011 to 3,632 in 2012.

Although adversary proceedings have declined for the third consecutive year, the number of adversary proceedings filed, closed, and pending during 2012 was still higher than that of 2008.