JUDICIAL CASELOAD

Bankruptcy Filings

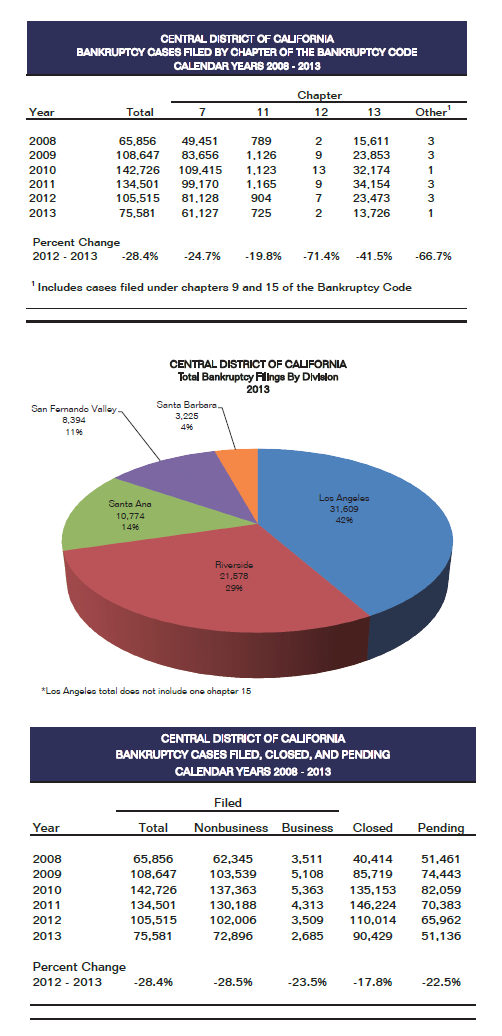

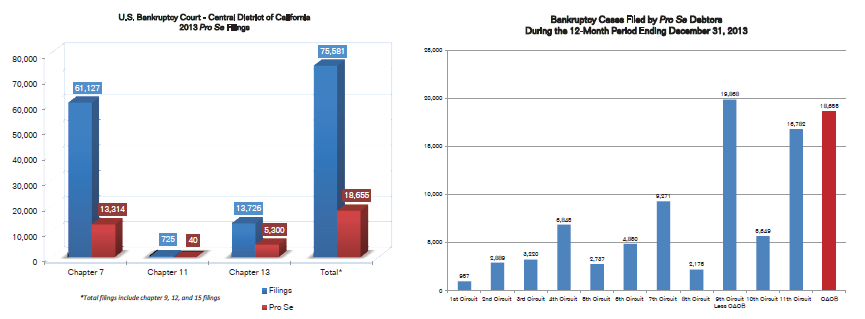

The Central District of California led the nation in overall bankruptcy filings for the sixth consecutive year. A total of 75,581 individual and business bankruptcy cases were filed during the 12-month period ending December 31, 2013, a 28.4 percent decrease from the 105,515 filings received in 2012.

The Central District of California led the nation in overall bankruptcy filings for the sixth consecutive year. A total of 75,581 individual and business bankruptcy cases were filed during the 12-month period ending December 31, 2013, a 28.4 percent decrease from the 105,515 filings received in 2012.

Chapter 7 filings decreased by 24.7 percent to 61,127 filings in 2013 and accounted for 80.9 percent of all petitions filed district-wide. Chapter 7 filings also accounted for 76.4 percent of all business filings and 81 percent of all nonbusiness filings in 2013.

Chapter 11 filings decreased 19.8 percent to 725. Chapter 11 cases, which typically require more judicial resources than cases that are filed under other chapters, accounted for approximately 1 percent of all petitions filed in 2013, consistent with the percentage of chapter 11 filings from 2012. Over 69 percent of chapter 11 petitions were business cases.

Chapter 13 filings decreased the most, declining by 41.5 percent. A total of 13,726 chapter 13 petitions were filed in 2013. Chapter 13 petitions accounted for 18.2 percent of all filings in 2013, down from 22.2 percent in 2012. Chapter 13 petitions also accounted for 18.7 percent of all nonbusiness filings and 4.8 percent of all business filings in 2013.

The number of bankruptcy petitions terminated by the Central District in 2013 decreased by 17.8 percent to 90,429. Because terminations exceeded filings in 2013, there were 51,136 cases pending in December 2013, which was 22.5 percent less than the number of cases pending in December 2012.

Although bankruptcy filings continued to decline for the third consecutive year, the Central District still averaged over 113,000 filings per year during the past five years, the highest five-year average in the Court’s history.

According to the national filing data released by the Administrative Office of the U.S. Courts for the 12-month period ending December 31, 2013, the Central District of California received 37.2 percent more bankruptcy filings than the second-largest district, the Northern District of Illinois. Bankruptcy filings in the Central District of California accounted for over 7 percent of the nation’s filings.

Pro Se Filings

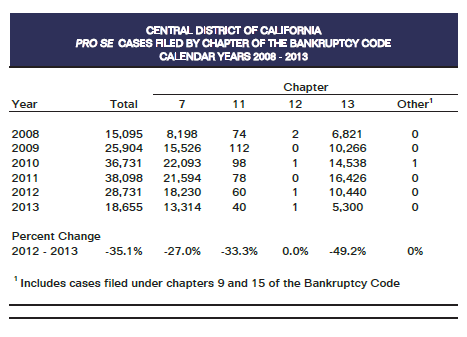

The Central District of California led the nation in both the number and percentage of pro se filings for the 12-month period ending December 31, 2013. The Central District’s rate of pro se filings for the year was 24.7 percent, nearly three times the national average of 8.8 percent and 3.1 percentage points higher than the next-highest district, Arizona, with 21.5 percent. The Central District handled nearly 20 percent of the entire nation’s pro se bankruptcy filings. Excluding the Ninth Circuit, the Central District alone handled more pro se filings than all other individual circuits. It had more pro se filings than the combined total of the First, Second, Third, Fifth, Sixth, and Eighth Circuits. If the Central District were treated as a circuit, it would be second only to the remainder of the Ninth Circuit in total pro se filings.

The Central District of California led the nation in both the number and percentage of pro se filings for the 12-month period ending December 31, 2013. The Central District’s rate of pro se filings for the year was 24.7 percent, nearly three times the national average of 8.8 percent and 3.1 percentage points higher than the next-highest district, Arizona, with 21.5 percent. The Central District handled nearly 20 percent of the entire nation’s pro se bankruptcy filings. Excluding the Ninth Circuit, the Central District alone handled more pro se filings than all other individual circuits. It had more pro se filings than the combined total of the First, Second, Third, Fifth, Sixth, and Eighth Circuits. If the Central District were treated as a circuit, it would be second only to the remainder of the Ninth Circuit in total pro se filings.

Of the 75,581 bankruptcy cases filed in the district, 18,655 were filed by pro se filers. Chapter 13 petitions had the highest pro se percentage with 38.6 percent, followed by chapter 7 petitions with 21.8 percent filed by pro se filers. Chapter 11 had the smallest percentage of pro se filings with 5.5 percent.

Adversary Proceedings

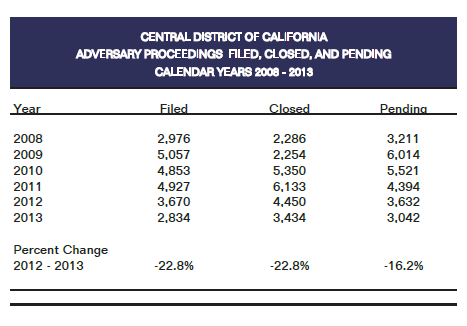

During the 12-month period ending December 31, 2013, adversary proceedings decreased nearly 22.8 percent from 3,670 in 2012 to 2,834.

The number of adversary proceedings terminated in 2013 declined to 3,434, a 22.8 percent decrease from the 4,450 terminated in 2012. Pending adversary proceedings decreased by 16.2 percent, from 3,632 in 2012 to 3,042 in 2013.

Cases of Interest

The cases of interest in 2013 reflect the unique population served in the Central District, as well the region’s economic climate. The following summaries include developments in select ongoing cases and highlights from new cases initiated in 2013.

City of San Bernardino

The City of San Bernardino filed chapter 9 in August 2012 and the case was assigned to Judge Meredith A. Jury. After the debtor provided financial information to objecting party CalPERS, the Court determined in May 2013 that the issues open for determination for eligibility to be in chapter 9 did not involve disputed issues of fact. Therefore, the Court asked the parties to address the eligibility of the City to be in chapter 9 with cross summary judgment motions. Those motions were heard in August and, after a lengthy hearing, the Court found the city was eligible to remain in chapter 9. That ruling by the Court is presently on appeal. District Court granted leave to appeal and certified the decision for direct appeal to the Ninth Circuit. The Bankruptcy Code provides that no stay pending appeal may be granted and the case will move forward toward plan confirmation. An effort to achieve a consensual plan has been initiated; all major parties proceeded to mediation with Judge Gregg W. Zive.

American Suzuki Motor Corporation

On November 5, 2012, American Suzuki Motor Corporation filed for bankruptcy protection, indicating plans to end its American auto sales and continue selling sports vehicles. The multimillion-dollar case was assigned to the Honorable Scott C. Clarkson, who was successful in keeping the case moving on a tight schedule. Claims listed on the case reached over $467 million, with creditors ranging from auto dealerships to tax entities, law firms, Suzuki entities such as Suzuki Canada, and many others. As outlined in its initial proceedings, Suzuki’s bankruptcy plan was approved in March 2013. General financial and auto media outlets attributed the decline in auto sales to the 2008 economic downturn and lack of American demand for small automobiles. By the end of the year, the chapter 11 case was closed, while the Court retained jurisdiction over a few outstanding matters.

KSL Media, Inc.

On September 11, 2013, KSL Media, Inc. filed for chapter 11 bankruptcy protection. However, the case was converted to a chapter 7 at the end of the year. The case is jointly administered with TV 10’s LLC and Fulcrum 5, Inc. KSL is the largest among these entities with assets and liabilities listed in the tens of millions. According to a motion filed by KSL, the company was “one of the largest independent media buying companies in the country, buying around $250-$350 million of media services annually in recent years.” Creditors such as Turner Broadcasting System, Inc., Hearst Communications, Inc., Home & Garden Television, the Travel Channel and the Television Food Network are just a few of the substantial claims listed on the case from many network and broadcasting companies.

Girls Gone Wild, LLC

GGW Brands, LLC, GGW Direct, LLC, GGW Events, LLC, and GGW Magazine, LLC (Original GGW Entities) each filed chapter 11 cases on February 27, 2013. After Wynn Las Vegas, LLC filed a motion seeking to appoint a trustee, the Court found “cause” and the best interests of creditors warranted appointment of a chapter 11 trustee over the estates of the Original GGW Entities. The Court later granted the trustee’s motion to revoke the cancellation of GGW Marketing, LLC, a related entity; file a bankruptcy petition on behalf of GGW Marketing, LLC; and initiate an adversary proceeding to recover trademarks and URLs vital to the Girls Gone Wild business, which the trustee alleged had been fraudulently transferred by various entities controlled by Joseph R. Francis, the creator of the Girls Gone Wild brand. The Court partially granted the trustee’s motion for summary judgment and entered a final judgment, finding that the transfers of the trademarks and URLs from GGW Marketing, LLC and GGW Brands, LLC to off-shore entities were fraudulent transfers. The final judgment was on appeal at year's end. The bankruptcy cases of the Original GGW Entities and GGW Marketing, LLC are being jointly administered.

Rhythm and Hues, Inc.

Oscar-winning computer graphics company Rhythm And Hues, Inc. (“Life of Pi”) filed its chapter 11 petition in early 2013. It had almost no assets and no employees. Its only hope was to keep its team of former employees together long enough for someone to buy the business for its going concern/team value. A "stalking horse" bidder would only enter into a non-binding letter of intent with a "breakup fee" even if it chose to withdraw. All key parties supported this as the only option, and after much questioning Judge Neil W. Bason approved a reduced breakup fee. That bidder soon backed out and demanded its fee, but by then other bidders had come forward and Judge Bason approved a settlement and a sale to another bidder. Later, Judge Sheri Bluebond and Judge Bason reviewed and approved settlements of class action suits by former employees and confirmed the debtor's liquidating plan.