KEY STUDIES, ACTIVITIES, AND ACCOMPLISHMENTS

Court Adopts Strategic Plan for 2014-2019

On September 6, 2013, the Board of Judges adopted a Strategic Plan for 2014-2019. The Strategic Plan was the product of an inclusive planning process in which judges, executive management, staff, attorneys, and the public came together during an 18-month period to craft a vision for the future of the Court. The Strategic Plan is composed of mission and vision statements, five strategic issues, 18 goals and 69 strategies. The five strategic issues are: 1) Administration of Justice; 2) Access to Justice and Service to the Public; 3) Judiciary Workforce of the Future; 4) A Solid Infrastructure; and 5) Public Understanding, Trust, and Confidence. The Strategic Plan was designed to assist the Court in meeting the significant challenges it faces over the next five years and to produce a more efficient, effective Court, providing the highest quality of justice to the people served in the Central District of California.

On September 6, 2013, the Board of Judges adopted a Strategic Plan for 2014-2019. The Strategic Plan was the product of an inclusive planning process in which judges, executive management, staff, attorneys, and the public came together during an 18-month period to craft a vision for the future of the Court. The Strategic Plan is composed of mission and vision statements, five strategic issues, 18 goals and 69 strategies. The five strategic issues are: 1) Administration of Justice; 2) Access to Justice and Service to the Public; 3) Judiciary Workforce of the Future; 4) A Solid Infrastructure; and 5) Public Understanding, Trust, and Confidence. The Strategic Plan was designed to assist the Court in meeting the significant challenges it faces over the next five years and to produce a more efficient, effective Court, providing the highest quality of justice to the people served in the Central District of California.

Impact of Judiciary Budget Challenges for the Court

As FY 2013 approached, Congress narrowly avoided a government shutdown and the Judiciary continued to operate with a constrained budget. Additionally, a more stringent staffing formula and nationally mandated financial plan reduction of 8 percent forced the Court to enter FY 2013 with a salary reduction of $1.7 million. As a result of sequestration, the Court’s salary allotment was further reduced by 4 percent, representing an additional loss of $858,478 and a total loss in salary funding of nearly $2.6 million. Nationally, the FY 2013 appropriations were approximately 10.4 percent less than the amount Congress provided courts in FY 2012 and 5.6 percent below the FY 2013 interim financial plan. Locally, the FY 2013 appropriation resulted in a 12 percent reduction to the Court’s budget allotments.

Due to these budget conditions as well as anticipated FY 2014 shortfalls, the Court was forced to implement involuntary staff reductions for the second consecutive year. In an effort to offset the impact of the judiciary shortfall, several staff members also accepted early retirement and buyout incentives offered by the Court. Throughout 2013, the Court continued to exercise caution with its expenditures and aggressively pursued cost-containment measures as budget challenges were anticipated for the next several years to come.

FY 2014 brought continued budget challenges. Despite receiving partial year allotments on September 30, 2013, the Court entered FY 2014 without an enacted continuing resolution or appropriations. Federal agencies were required to adopt plans for operating without annual appropriations. In order to avoid a complete shutdown of Judiciary operations, available fees and no-year appropriations were utilized to fund operations through October 15, 2013.

On October 16, 2013, the President signed the Continuing Appropriations Act 2014, or Continuing Resolution (CR), which funded the federal government, including the Judiciary, through January 15, 2014. The CR provided discretionary appropriations at the FY 2013 post-sequestration level, with the exception of two funding increases and a 1 percent Employment Cost Index (ECI) cost-of-living adjustment for federal workers which took effect in January 2014. Overall, the FY 2014 interim plan resulted in funding to the Judiciary that was approximately 2.7 percent below FY 2013 allotments on a national basis.

Career Transition Center

The Judiciary’s budget shortfall, coupled with the Court’s decline in case filings and additional reductions resulting from the new staffing formula, created significant budget challenges for the Court. On September 10, 2013, in response to the dire situation, the Court notified 19 employees that they would be involuntarily separated from service.

To assist the employees in moving forward, the Court established a Career Transition Center. The center, which remained open for the duration of the displaced employees’ four-week notification period, provided training on topics such as résumé writing, using Microsoft Word and Excel, networking through social media, and improving interviewing skills. The center made computers, faxes, phones, and other job search resources available to outgoing employees and put them in direct contact with the Employee Assistance Program (EAP), California’s Employment Development Department (EDD), and WorkSource job placement centers. The Bar was extremely supportive and actively partnered with the Court to publicize job opportunities in local law firms for displaced staff.

Central District Cuts Costs through Efficient Noticing

For the past several years, the Central District of California’s noticing practices have resulted in the lowest cost per new case filed of any bankruptcy court. In 2011 and 2012, the Central District’s low Bankruptcy Noticing Center (BNC) costs saved the Judiciary approximately $3.65 million. In 2013, the Central District was ranked the most efficient in the nation when BNC costs are measured per new case filed. The Central District had the fifth-lowest average cost per notice. These savings and increase in efficiency were the direct result of the Court’s policies and practices related to Notice of Electronic Filing (NEF). NEF allows registered users to receive notices and orders electronically from CM/ECF, and they are accessible around-the-clock. For these attorneys, trustees, and others, the BNC no longer sends any notices or orders. Therefore, the BNC sends each notice to fewer recipients. In addition, the Court’s efforts in streamlining noticing practices, particularly entered orders, have resulted in notices that consist of the fewest possible pages, yet retain all essential information. As a result, the BNC does not need to print and mail pages containing superfluous information. For example, the Court condensed the Order Confirming Chapter 13 Plan from eight pages to two pages. The Court combined the Order of Dismissal and the Notice of Dismissal into one notice titled “Order and Notice of Dismissal.” And, in 2012, the Court eliminated the requirement that a Proof of Service be included in lodged orders, as proof of service is noted when a Notice of Lodgment is filed. All of these actions contributed to reduced noticing costs in the Federal Judiciary.

Clerk's Office Offers Comprehensive Shared Administrative Services

In 2013, the Court created a Shared Administrative Services (SAS) team to implement a Judiciary cost-containment policy. The Court’s SAS team collaborated to design service offerings and create a process by which the Court would be able to offer services as an economical way to maximize sharing resources among courts and sister agencies. The Court set up a web page on its internal website listing service offerings ranging from training services, to space planning, to web design. SAS service offerings were grouped into three strategic lines of business: Human Capital, Information Technology, and Space and Facilities. Services were offered to court units on a cost reimbursable basis established through a Memorandum of Understanding (MOU). Individual service offerings were posted to “JShare,” the judiciary’s SAS website, with a link to the Court’s SAS web page and catalog.

Specific services provided for a fee to other court units beginning in FY 2013 included the following:

- Drupal customization and training services provided to the U.S. Bankruptcy Court for the Southern District of California;

- Contracting Officer Representative training provided to the following Central District court units: U.S. District Court, U.S. Probation Office, and U.S. Pretrial Services;

- Automation classes provided to the U.S. District Court, Central District of California;

- NextGen CM/ECF programming services provided to the Administrative Office of the U.S. Courts;

- WordPerfect to Word conversion and macros creation provided to the U.S. District Court, District of Nebraska; and

- Time management training provided to the U.S. Bankruptcy Court, Northern District of Oklahoma.

Court Publishes Second Annual Pro Se Report

In 2013, the Court published its second annual pro se report, Access to Justice: Self-Represented Parties and the Court. The report provided an in-depth look at the Court’s joint effort with public service partners to assist self-represented individuals. Access to Justice compared the outcomes for debtors who filed bankruptcy pro se, with counsel, or with bankruptcy petition preparers (BPP); described the Court’s progress in providing services to pro se litigants; and detailed pro bono work throughout the district. According to the report, approximately 300 volunteers assisted the Court in 2012, making access to justice a reality for over 9,000 individuals.

In 2013, the Court published its second annual pro se report, Access to Justice: Self-Represented Parties and the Court. The report provided an in-depth look at the Court’s joint effort with public service partners to assist self-represented individuals. Access to Justice compared the outcomes for debtors who filed bankruptcy pro se, with counsel, or with bankruptcy petition preparers (BPP); described the Court’s progress in providing services to pro se litigants; and detailed pro bono work throughout the district. According to the report, approximately 300 volunteers assisted the Court in 2012, making access to justice a reality for over 9,000 individuals.

The impact of the Court’s consistently high number of pro se filers is noteworthy in both the increased labor it creates for the Court and the diminished successful case completion rate it produces for pro se filers, as compared to filers with attorney representation. The overall incomplete rate of the Court’s pro se cases in 2012 was a sizeable 30 percent. Incomplete filings were described in the report as a common characteristic of fraudulent and abusive bankruptcy cases used solely for the benefit of an automatic stay. Also, the report’s analysis, resulting from the Court’s recent BPP tracking efforts, revealed that both pro se and BPP assisted filers in chapter 13 had a miniscule success rate, even in reaching the threshold confirmation of a bankruptcy plan. This is especially noteworthy given that chapter 13 had the highest pro se percentage of all filings in 2012. The report’s findings emphasized that attorney representation remains the best option for individuals served by the Court, underscoring the importance of pro bono assistance in the absence of such representation.

Mediation Program

The Court established its Bankruptcy Mediation Program in 1995 to provide the public with effective and reliable assistance in resolving disputes without the time and expense associated with litigation. The mediation panel consists of attorneys and non-attorney professionals such as accountants, real estate brokers, physicians, and professional mediators, and in 2013, had 177 members. The Court continues to add new members on an ongoing basis as mediators who joined the panel at its inception in 1995 retire. The Mediation Program entered in its 18th year in 2013 and remains the largest and most robust bankruptcy mediation program in the nation.

From the program's inception in 1995 through the end of 2013, the judges assigned 5,110 matters to mediation. Of those matters, 4,473 were concluded and 2,805 of the concluded matters were settled. The settlement rate has held steady over the years at a very impressive rate of 63 percent.

FedInvest

On February 26, 2013, the Court began investing its registry funds through FedInvest, a Federal Investment Program application. FedInvest, formerly Court Registry Investment System (CRIS), replaced the Court On-Line Banking (COLB) system, through which the Court previously invested its registry funds in a money market account with Bank of America. Under FedInvest, monitored by the Administrative Office of the U.S. Courts and the FedInvest Fund Manager, the Court’s funds are pooled together with those of all courts registered with the system. The combined funds are invested in Treasury securities through the Bureau of the Public Debt, improving liquidity. With FedInvest, the Court does not have to keep collateral for deposits and can pay distributions through FAS4T, the Judiciary’s accounting system.

Internal Controls and Audits

Annually, the Court must ensure that a self-assessment of internal controls is conducted to ensure compliance with the Administrative Office of the U.S. Courts and local policies. The intended purpose of the reviews is to provide an objective analysis of each department’s operations in an effort to help management improve its operations. The reviews are essential in providing accountability for public resources.

In 2013, the Clerk’s Office conducted evaluations of internal controls for the following areas:

- Financial Management;

- Procurement;

- Property Management;

- Human Resources

- Information Technology/Security; and

- Operations (All Divisions).

Increase in Unclaimed Funds Payments

Unclaimed funds are funds held by the Court for an owner that has either failed to claim the funds, failed to negotiate a payment of the funds, or cannot be located. Unlike most claims against the government, a claim for unclaimed deposit or registry funds is never extinguished. The claim exists in perpetuity and the funds may be claimed at any time by the owner, a successor, or any other petitioner that proves a right to the funds.

Compared to the three previous years, the Financial Services Department paid a record amount in unclaimed funds in 2013. A record $1.94 million was paid out from January to December of 2013. The second-highest year in the three-year period was $1.24 million, achieved in 2012.

Local Bankruptcy Rules Revised

The Court revised its Local Bankruptcy Rules (LBRs) in 2013 to eliminate the Notice of Entered Order and Service List (NOE) requirement. Previously, the NOE determined who would be served with an entered order by U.S. Mail. However, advances in automation have eliminated the need for the NOE. All LBR form orders were revised to remove the NOE.

Additionally, the LBRs were revised to clarify responses to motions and dismissal of motions, add a procedure for a creditor or debtor to follow when a filed document mistakenly contains a personal identifier, clarify practice for motions and contested matters and motions and matters determined without additional notice and without a hearing, and clarify the standard for hearings on less than 48 hours’ notice. The Court Manual was also updated to reflect revisions to the LBRs. The revised LBRs and LBR forms became effective on January 2, 2014.

Bar Advisory Board Continues

Initially formed in 2009, the Court’s Bar Advisory Board (BAB) meets quarterly with the Chief Bankruptcy Judge, other interested judges, and the Executive Officer/Clerk of Court. The 2013 members of the Bar Advisory Board included: Peter Anderson, U.S. Trustee; Jeff Krieger, Los Angeles County Bar Association, Commercial Law and Bankruptcy Section; Andrew Goodman, San Fernando Valley Bar Association, Business Law and Bankruptcy Section; M. Jonathan Hayes, Central District Consumer Bankruptcy Attorneys Association; Marjorie Johnson, Inland Empire Bankruptcy Forum; David W. Meadows, Los Angeles Bankruptcy Forum; Hamid R. Rafatjoo, Orange County Bankruptcy Forum; and Kelly Zinser, Orange County Bar Association, Commercial Law and Bankruptcy Section. The BAB provides a conduit for the Court to disseminate information to the bar and obtain feedback on various issues of mutual concern. In 2013, the BAB assisted the Court in the development of the Court’s Strategic Plan, and helped form the Bar Rules Advisory Group to draft updates to the Court’s relief from stay forms, address bankruptcy foreclosure abuse in the real estate industry, and develop electronic filing capabilities for pro bono attorneys.

Court Forms Bar Rules Advisory Group

In January 2013, the Court’s Rules Committee established the Bar Rules Advisory Group (BRAG) comprised of attorneys from throughout the district who collectively represent debtors, creditors, individuals, businesses, and in matters involving real property and personal property. The first BRAG meeting, held in March 2013, was attended by 40 attorneys. The BRAG provided input regarding the Court’s Extraordinary Relief Attachment and the concept of a judicial variance statement.

The BRAG’s first task was to draft revisions to the Court’s 10 Local Bankruptcy Rules (LBR) forms for Relief From the Automatic Stay (RFS). A BRAG RFS working group, chaired by attorney Keith Higginbotham and consisting of 11 attorneys, held a series of extensive meetings from March through June with five goals: improve consistency among RFS forms; revise content to reflect current law; maintain relief requests according to preferences of judges; use vocabulary the bar finds useful; and improve clarity of format and organization. By August 2013, the RFS working group provided drafts of the RFS forms for the Court’s consideration. The final versions of the RFS forms are anticipated to be released in June 2014. In 2014, the BRAG will be providing the Rules Committee with input on the Court’s LBR forms for individual chapter 11 cases, among other matters.

Central District Pilots DeBN Program

In 2013, the Court partnered with the Administrative Office of the U.S. Courts (AO) to design and participate in the Debtor Electronic Bankruptcy Noticing (DeBN) pilot program. DeBN is an electronic noticing program that works in conjunction with the Bankruptcy Noticing Center.

During the pilot, debtors will be able to receive entered orders and court-generated notices by email instead of U.S. mail (e.g., 341(a) Meeting of Creditors notice, Notice of Deficiency, Notice of Discharge, Notice of Dismissal, etc.) A debtor who requests DeBN consents only to service of court entered orders and court-generated notices by email. Service requirements for litigants do not change with DeBN.

The implementation of DeBN is expected to provide faster and more efficient service of entered orders and court-generated notices to debtors and significantly reduce noticing costs. Because debtors receive court orders and notices the same day as their attorneys, DeBN is also expected to improve attorney-client communications.

The Court completed the initial development of the program in 2013. Testing of DeBN using live cases filed by attorney volunteers will commence in 2014.

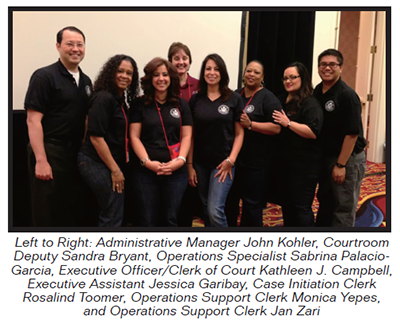

Court Staff Attends 2013 NCBC Conference

From August 12 to August 15, 2013, Clerk’s Office staff from bankruptcy courts across the country converged in Baltimore, Maryland to attend the 33rd Annual National Conference of Bankruptcy Clerks (NCBC). Hosted by the U.S. Bankruptcy Court for the District of Maryland, clerks from over 30 different bankruptcy courts took advantage of NCBC’s educational opportunities and networking events. Eight delegates, led by Executive Officer/Clerk of Court Kathleen J. Campbell, represented the Central District of California.

From August 12 to August 15, 2013, Clerk’s Office staff from bankruptcy courts across the country converged in Baltimore, Maryland to attend the 33rd Annual National Conference of Bankruptcy Clerks (NCBC). Hosted by the U.S. Bankruptcy Court for the District of Maryland, clerks from over 30 different bankruptcy courts took advantage of NCBC’s educational opportunities and networking events. Eight delegates, led by Executive Officer/Clerk of Court Kathleen J. Campbell, represented the Central District of California.

Presentations and breakout sessions covered guidelines for using social media, how to learn from mistakes, motivation and engagement on the job, transitioning and surviving tough economic times, teamwork, project management, legal issues in human resources, the next generation of CM/ECF, and a budget update from the Administrative Office of the U.S. Courts.

Two courses from the Michigan State University (MSU) Judicial Administration certificate program were offered at the NCBC Conference. The courses were “Education, Training, and Development” and “Essential Components of Courts.” Five members of the Clerk’s Office staff participated in the 2013 MSU course offerings. Students in the program gained education and exposure to the various different aspects of court management and administration.

2013 National Emergency Preparedness Workshop

In August 2013, Administrative Specialist Herbert Seales represented the Court at the three-day National Emergency Preparedness Workshop hosted by the Administrative Office of the U.S. Courts in Washington, D.C. The focus of the workshop was to create a national program designed to assist emergency practitioners throughout the Judiciary. This workshop was the first phase in a long-term project to enhance the emergency management tools available to all judicial agencies.