JUDICIAL CASELOAD

Bankruptcy Filings

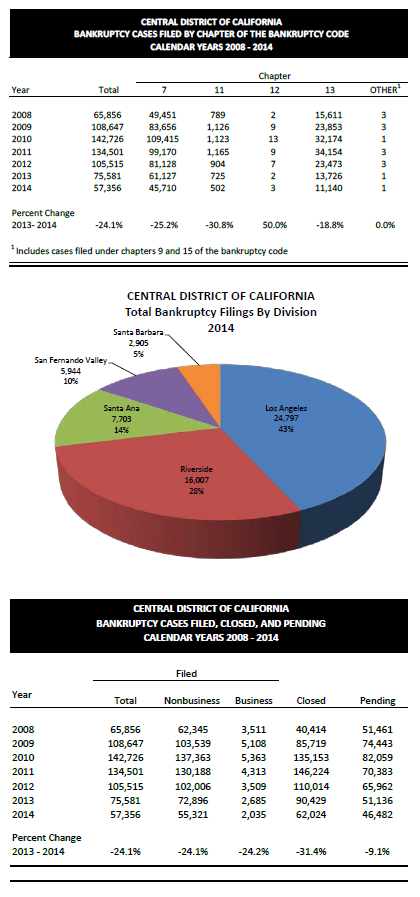

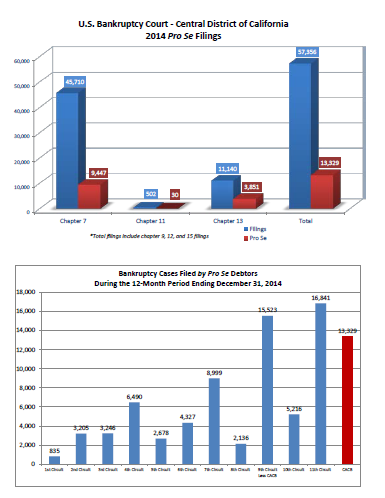

The Central District of California led the nation in overall bankruptcy cases filed for the seventh consecutive year. A total of 57,356 individual and business bankruptcy cases were filed during the 12-month period ending December 31, 2014, a 24.1 percent decrease from 75,581 filings received in 2013. Filings for all chapters declined significantly.

The Central District of California led the nation in overall bankruptcy cases filed for the seventh consecutive year. A total of 57,356 individual and business bankruptcy cases were filed during the 12-month period ending December 31, 2014, a 24.1 percent decrease from 75,581 filings received in 2013. Filings for all chapters declined significantly.

Chapter 7 filings decreased by 25.2 percent to 45,710 filings in 2014 and accounted for 79.7 percent of all petitions filed district-wide. Chapter 7 filings also accounted for 79.0 percent of all business filings and 79.7 percent of all nonbusiness filings in 2014.

Chapter 11 filings decreased 30.8 percent to 502. Chapter 11 cases, which typically require more judicial resources than cases that are filed under other chapters, accounted for approximately 0.9 percent of all petitions filed in 2014, consistent with the percentage of chapter 11 filings from 2013. Over 64 percent of chapter 11 petitions were business cases.

Chapter 13 filings decreased 18.8 percent to 11,140 filings in 2014. Chapter 13 petitions accounted for 19.4 percent of all filings in 2014, up from 18.2 percent in 2013. Chapter 13 petitions also accounted for 20.0 percent of all nonbusiness filings and 4.8 percent of all business filings in 2014.

The number of bankruptcy petitions terminated by the Central District in 2014 dropped 31.4 percent to 62,024. Because terminations exceeded filings in 2014, there were 46,482 cases pending in December 2014, which was 9.1 percent less than the number of cases pending in December 2013.

Although bankruptcy filings continued to decline for the fourth consecutive year, the Central District still averaged 103,136 filings per year during the past five years, the fifth highest average in the Court’s history.

According to the national filing data released by the Administrative Office of the U.S. Courts (AO), for the 12-month period ending December 31, 2014, the Central District of California received 11.9 percent more bankruptcy filings than the second-largest district, the Northern District of Illinois. Additionally, the Central District of California led the nation with the highest total of business, and non-business filings. Bankruptcy filings in the Central District of California account for over 6 percent of the nation’s filings.

Pro Se Filings

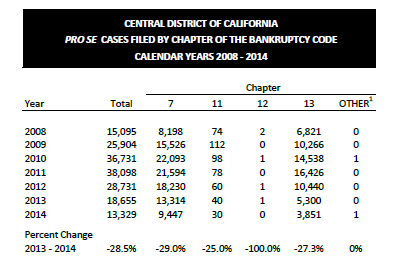

The Central District of California led the nation in both the number and percentage of pro se filings for the 12-month period ending December 31, 2014. The Central District’s rate of pro se filings for the year was 23.2 percent, nearly three times the national average of 8.8 percent and 5.5 percentage points higher than the next-highest district, the Middle District of Florida, with 17.7 percent. The Central District of California handled 16.1 percent of the entire nation’s pro se bankruptcy filings. Excluding the remainder of the Ninth Circuit and the Eleventh Circuit, the Central District alone handles more pro se filings than all remaining individual circuits. Also, the Central District had more pro se filings than the entire First, Second, Third, Fifth, Eighth, and District of Columbia Circuits combined.

Of the 57,356 bankruptcy cases filed in the Central District, 13,329 were filed by pro se filers. Chapter 13 petitions had the highest pro se percentage with 34.6 percent, followed by chapter 7 petitions with 20.7 percent filed by pro se filers. Chapter 11 had the smallest percentage of pro se filings with 6 percent.

Adversary Proceedings

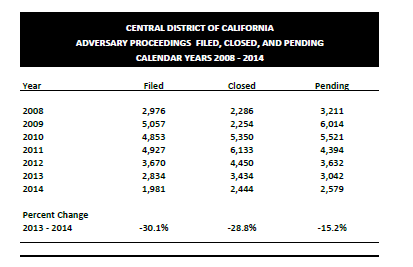

During the 12-month period ending December 31, 2014, adversary proceedings decreased 30.1 percent from 2,834 in 2013 to 1,981.

The number of adversary proceedings terminated in 2014 declined by 28.8 percent to 2,444 from 3,434 terminated in 2013. Pending adversary proceedings fell 15.1 percent, from 3,045 in 2013 to 2,584 in 2014.

Cases of Interest

The cases of interest in 2014 reflect the unique population served in the Central District, as well the region’s economic climate. The following summaries include developments in select ongoing cases and highlights from new cases initiated in 2014.

City of San Bernardino

The City of San Bernardino continued to draw national attention as one of the largest cities to pursue bankruptcy protection. The City filed bankruptcy on August 1, 2012, but had yet to confirm a plan through the end of 2014. The City, with an estimated population of 205,000, underwent financial strain following the great recession of 2008. Benefits provided to public employees have been cited by the City as a main cause of its ongoing financial struggle and have been discussed as the source of financial trouble for other cities across the nation following the great recession.

Prolonged negotiations between the City and its public safety unions have also been blamed for the delayed confirmation of an exit plan. The Honorable Meredith A. Jury imposed a deadline on the City of May 30, 2015 to propose a plan. A major step taken in 2014, following lengthy mediation, was the City’s statement of its intent to cover all payments owed to CalPERS for the retirement plans of the City’s public employees.

Law v. Siegel

On March 4, 2014, a unanimous Supreme Court reversed the bankruptcy court’s equitable surcharge of Mr. Law’s $75,000 homestead exemption, based on § 522(k) which states, “Property that the debtor exempts under this section is not liable for payment of any administrative expense . . . .” The Supreme Court said the Court exceeded the limits of its authority under § 105(a) and its inherent powers.

Upon remand, Law moved to collect his homestead claim, though no funds remained in the bankruptcy estate. At a preliminary hearing, the parties were asked to confer and to file further pleadings. Law filed two pleadings: (1) an appeal to the Ninth Circuit of the Bankruptcy Appellate Panel’s earlier decision affirming a 2013 order approving the trustee’s amended final report; and (2) a petition for mandamus to the Ninth Circuit seeking payment of his claim. Both are pending. No other pleadings have been filed.

Plaza Healthcare, LLC

Plaza Healthcare, along with eighteen affiliated nursing facilities, filed for chapter 11 bankruptcy protection on March 4, 2014. Collectively, these facilities had 1,711 patients, 2,113 employees, and 1,905 beds. Plaza generates annual revenue of approximately $170 million. The Court determined that it was in the best interest of all parties to create an overall deal structure to prevent the facilities from being sold piecemeal, and authorized the debtor facilities to enter into an interim management agreement with the winning bidder at auction to allow the winning bidder to take over management of the facilities until the acquisition became final. An auction was held on July 28, 2014, and Shlomo Rechnitz was declared the winning bidder. The term sheet for the acquisition included a $32 million dollar deposit and a total sales price of $62 million. The Court anticipates a plan will be filed sometime in the second quarter of 2015.

Easy Life Furniture Inc.

On May 1, 2014, Easy Life Furniture filed a chapter 11 bankruptcy in order to liquidate assets at its warehouse in Buena Park, and its 14 retail locations across Southern California. Formed in 1996, Easy Life reported yearly sales averaging $43 million, assets of $6.3 million, and debts of roughly $12 million. Easy Life rejected all 14 store leases as well as the lease of its headquarters and warehouse, conducted going out of business sales at its retail locations to sell off its inventory, and conducted a bulk auction for the remainder of its assets in court on July 2, 2014. The debtor now has reduced its assets to cash and is currently addressing the case's remaining claims.

Individual Bankruptcies Receiving Media Attention

Mekhi Phifer

On April 22, 2014, Mekhi Phifer, the actor known for his role in the 90’s television show, ER, filed a chapter 7 bankruptcy petition listing under $100,000 in assets and over $1 million in debt, largely attributed to monies owed for federal and state income taxes. The actor received a discharge of over $1.26 million in debt on August 4, 2014.

Pierce Henry O’Donnell

Pierce Henry O’Donnell, the attorney who assisted with the sale of the Los Angeles Clippers basketball team, filed a chapter 7 bankruptcy petition on August 20, 2014. The petition, filed in the weeks immediately after the sale of the team, was supported by many fans in the wake of controversy over statements made by its previous owner, Donald Sterling. Attorney O’Donnell’s bankruptcy petition listed assets of under $500,000 and several million dollars in debt.

Judges Relocated

In May 2014, Chief Judge Peter H. Carroll relocated from the Los Angeles Division to the Northern Division and Judge Deborah J. Saltzman relocated from the Riverside Division to the Los Angeles Division. Judge Robin L. Riblet retired on May 9 and assumed recalled status on May 11.

Northern Division Expanded

On May 10, 2014, ZIP codes for the cities of Simi Valley, Thousand Oaks, Westlake Village, Newbury Park, and Malibu were reassigned to the Northern Division. The ZIP codes include: 90263, 90264, 90265, 91319, 91320, 91358, 91359, 91360, 91361, 91362, 93062, 93063, 93064, 93065, 93094, and 93099. The Clerk's Office completed this ZIP code realignment, as well as changes to the Court Manual, the Court's website, the Court's cashiering system, and Case Management/Electronic Case Files (CM/ECF), in a seamless and timely manner.

Cases Reassigned to Judge Yun

Concurrent with the start of Judge Scott H. Yun’s term, many bankruptcy cases and adversary proceedings in the Riverside Division were reassigned. On July 21, 2014, Judge Yun was placed on the Riverside Division case assignment wheel. Also on that day, Judge Deborah J. Saltzman’s pending Riverside Division cases were transferred to Judge Yun, including 566 chapter 7 cases, 20 chapter 11 cases, 1,992 chapter 13 cases, and 86 adversary proceedings.