KEY STUDIES, ACTIVITIES, AND ACCOMPLISHMENTS

Judiciary Budget Challenges for the Court

In 2014, the Judiciary continued to operate in a constrained budget climate. For court units, this meant operating under a Continuing Resolution (CR). In January, the President of the United States signed the “Consolidated Appropriations Act of 2014.” The Executive Committee of the Judicial Conference approved final financial plans for FY 2014 and courts received the balance of their FY 2014 allotments on February 18. Although funding in the final financial plan for court allotments represented a net increase of 5.8 percent above FY 2013 allotment levels, total FY 2014 court allotments were still approximately $100 million below FY 2012 allotments and the equivalent of FY 2008 allotment levels on a national basis. Locally, the FY 2014 appropriation resulted in a 10.6 percent reduction to the Court’s budget allotments.

Throughout 2014, the Court continued to exercise caution with its expenditures and aggressively pursued cost-containment measures. In addition, the Court was able to secure supplemental funding to mitigate the deficit through shared administrative services and partnering with the Administrative Office of the U.S. Courts (AO) on national projects and initiatives. With continued prudent spending and conservation of resources, the Court was able to end the fiscal year without the necessity of layoffs or furloughs.

Despite the Court’s ongoing cost-containment efforts, the budget outlook for FY 2015 remained uncertain. The Court received partial year allotments under the interim financial plan on September 30 and the Court began FY 2015 with a CR, which remained in effect through December 11, 2014. Nationally, the interim financial plan increased funding for court allotments by approximately 3.9 percent over FY 2014 levels but was still approximately 7.1 percent below FY 2015 full formula requirements. As anticipated, the Court’s budget was reduced by 5.9 percent, representing a loss of $929,249 in salary funding alone.

Given the Court’s decrease in filings, anticipated increase in shared administrative services cut, and expected across-the-board budget cuts in subsequent years, significant shortfalls are expected in FY 2016 and beyond.

Electronic Self-Representation Software Offered to Pro Se Debtors

On March 31, 2014, the Central District of California installed the Electronic Self-Representation (eSR) software successfully in the live environment. eSR is an online tool to help individuals complete a chapter 7 bankruptcy petition when they have decided to file bankruptcy without an attorney. The implementation of eSR has been and continues to be a collaborative project with the New Jersey and New Mexico bankruptcy courts and the Administrative Office of the U.S. Courts (AO). Judge Maureen A. Tighe spearheaded the Court's participation leading the local effort with court staff in the Pathfinder Working Group. Court staff worked over the weekend to ensure the software was ready and that no significant glitches would appear for first-time users.

On March 31, 2014, the Central District of California installed the Electronic Self-Representation (eSR) software successfully in the live environment. eSR is an online tool to help individuals complete a chapter 7 bankruptcy petition when they have decided to file bankruptcy without an attorney. The implementation of eSR has been and continues to be a collaborative project with the New Jersey and New Mexico bankruptcy courts and the Administrative Office of the U.S. Courts (AO). Judge Maureen A. Tighe spearheaded the Court's participation leading the local effort with court staff in the Pathfinder Working Group. Court staff worked over the weekend to ensure the software was ready and that no significant glitches would appear for first-time users.

With Judge Tighe shepherding the local effort over the preceding three years, the Court reached a major milestone on April 16, when a pro se debtor submitted an electronic bankruptcy petition in the Los Angeles Division. The filing marked the inaugural use of the eSR software nationwide. The following week Riverside Division’s self-help clinic became the second to offer eSR to its visitors. Public Counsel in Los Angeles, and Public Service Law Corporation in Riverside, each assisted the Court by pre-screening for visitors with computer proficiency who might be interested in using eSR for preparing bankruptcy petitions electronically.

After making several improvements based on feedback from its initial users, the Court soft-launched eSR software on the internet for general access by the public on September 24. While eSR can be used to prepare chapter 13 petitions, the Court has chosen to focus its initial efforts on the preparation of chapter 7 petitions.

In addition to eSR’s internet launch, the Court installed the software in the self-help desk areas in the remaining three divisions. Staff members were trained on how the eSR software works and on how to upload incoming eSR petitions. Attorneys volunteering in the self-help clinics were also provided training and an overview of eSR and case processing. This ensures that pro bono attorneys staffing the clinics are prepared to answer any questions debtors using the eSR software may have.

While expanding the availability of eSR to court users, the Court continues to monitor eSR, collect user feedback and collaborate on upgrades to improve the software, as needed.

Central District Permanently Adopts Debtor Electronic Bankruptcy Noticing

In September 2014, the Central District’s Debtor Electronic Bankruptcy Noticing (DeBN) pilot was adopted by the Board of Judges as a permanent program. Three months later, the Administrative Office of the U.S. Courts (AO) announced the availability of DeBN program to bankruptcy courts across the nation.

In September 2014, the Central District’s Debtor Electronic Bankruptcy Noticing (DeBN) pilot was adopted by the Board of Judges as a permanent program. Three months later, the Administrative Office of the U.S. Courts (AO) announced the availability of DeBN program to bankruptcy courts across the nation.

If debtors activate their DeBN accounts before five o’clock on the day they file their cases, the BNC will transmit their court notices by email the same day. Debtors are less likely to misplace their court notices because the emailed PDF attachments can be printed, saved to a computer, forwarded, or retained in the email for viewing at any time. Debtors can register for DeBN at any time during their case, and there are no logins or passwords to remember.

While DeBN was primarily established as a noticing improvement for debtors, DeBN also reduces BNC costs for debtor noticing for up to 90% over the life of a case.

With DeBN, debtors only receive the orders and court-generated notices by email that they otherwise would have received at a mailing address (e.g., 341(a) Meeting of Creditors notice and Order of Discharge). A debtor who requests DeBN consents only to service of orders and court-generated notices by email. Service requirements for all other litigants do not change with DeBN.

Since the DeBN pilot program began on February 24, over 1,300 DeBN activation forms were filed district-wide in 2014. Approximately 90% were filed in-person, while the other 10% were filed electronically by debtors’ attorneys.

Clerk's Office Expands Shared Administrative Services

Since 2013, when the Court created a Shared Administrative Services (SAS) offerings team to implement a judiciary cost-containment policy, more than 27 service agreements have been negotiated with courts and federal agencies. The Court’s SAS team collaborated in 2013 to design service offerings and create a process by which the Court would be able to offer services as an economical way to maximize sharing resources among courts and sister agencies. The Court set up a webpage on its internal website listing diverse service offerings, including training services, space planning, and web design. SAS service offerings were grouped into three strategic lines of business: Human Capital, Information Technology, and Space and Facilities. Services were offered to court units on a cost-reimbursable basis established through a Memorandum of Understanding (MOU). Individual service offerings were posted to JShare, the Judiciary’s SAS website, with a link to the Court’s SAS webpage and catalog.

In 2014, the Court completed 15 SAS agreements with courts and sister agencies near and far, worth more than $80,000 in revenue for the fiscal year ending September 30, 2014. To help market the Court’s Shared Administrative Services, representatives from the Clerk’s Office hosted an information table at the National Conference of Bankruptcy Clerks where flyers, a Quick Response (QR) code linking to the Court’s Shared Services webpage, and complimentary postcards were provided to those in attendance.

The following shared services agreements were negotiated in 2014:

Automation Training

- On June 3, Information Technology and Training Manager Padraic Keohane led an Adobe Acrobat Fillable Forms WebEx training for the U.S. Bankruptcy for the District of Oregon.

- On June 17 and June 18, Mr. Keohane provided on-site Microsoft Word training to the U.S. Bankruptcy Court for the Western District of Washington. He also provided a WebEx make-up class at the end of July for those who were unable to attend the on-site training.

- Throughout 2014, Mr. Keohane assisted the U.S. Bankruptcy Court for the Northern District of Georgia, both on-site and remotely, with converting templates and providing training for converting documents from WordPerfect to Microsoft Word.

- Locally, throughout 2014 Mr. Keohane also assisted the U.S. District Court for the Central District of California with Microsoft Office training, including Word, PowerPoint, and Excel.

Management and Leadership Training

- On May 15, Training Specialist Tina Sandoval traveled to Louisiana to provide performance management training to the U.S. Probation Office and Pretrial Services for the Eastern District of Louisiana.

- On September 8 through September 10, Mr. Keohane traveled to Sacramento, California and presented a training program to the U.S. Bankruptcy Court for the Eastern District of California entitled, “Developing Objectives-based Training.”

Website Development

- The Court’s resident website designer, Training Specialist Kimberly Rubal, continued to assist other courts with the transition of their websites to the new national Drupal template. During 2014, Ms. Rubal assisted the U.S. Bankruptcy for the District of Oregon with web design using the Drupal template and website content migration. She also provided a brief consultation to the U.S. Bankruptcy Court for the District of Montana.

Support Services

- On June 30, the Court entered into an extension of the agreement with the Administrative Office of the U.S. Courts (AO) for the Court’s software developers to work on the Next Generation (NextGen) Case Management/Electronic Case Files (CM/ECF) remotely.

- At the beginning of July, Internal Controls Analyst Jose Ramirez provided internal auditing services to the U.S. District Court for the Central District of California.

- On July 9, the Court entered into an MOU with the U.S. District Court for the Central District of California to provide IT and facility support services for Magistrate Judge Louise A. LaMothe in Santa Barbara through September 30.

- On July 18, the Court entered into an MOU with the U.S. Bankruptcy Court for the District of New Mexico to provide video production services. Personnel from the Court updated educational videos posted on New Mexico’s website for pro se debtors. The first video updated the filing fee information to reflect this year’s fee increase.

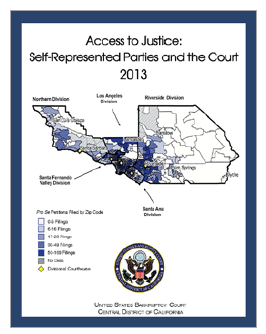

Court Publishes Third Annual Pro Se Report

Published September 2014, the Court’s 2013 pro se report, Access to Justice: Self-Represented Parties and the Court, addresses a 24.7 percent filing rate of self-represented parties in the Central District and describes the commitment of the Court and pro bono organizations. Judge Maureen A. Tighe, chair of the Pro Se Committee, spearheaded the Court’s third annual report on the Central District’s self-represented filers. The report incorporates statistics on assistance provided to this population by the local pro bono organizations serving each of the Court’s five divisions.

Published September 2014, the Court’s 2013 pro se report, Access to Justice: Self-Represented Parties and the Court, addresses a 24.7 percent filing rate of self-represented parties in the Central District and describes the commitment of the Court and pro bono organizations. Judge Maureen A. Tighe, chair of the Pro Se Committee, spearheaded the Court’s third annual report on the Central District’s self-represented filers. The report incorporates statistics on assistance provided to this population by the local pro bono organizations serving each of the Court’s five divisions.

As discussed in the report, the Court and local pro bono organizations continued their efforts to improve service to self-represented filers. The Court offered additional online resources for self-represented parties and outreach to pro bono volunteers in 2013, and pro bono organizations continued providing guidance to hundreds of self-represented parties who could not afford legal counsel. The assistance provided by these organizations was made possible, in part, by continued fundraising efforts and awards such as the Earle Hagen Memorial Golf Tournament, bar association holiday parties, and grants from the American College of Bankruptcy and the American College of Bankruptcy Foundation. Additionally, the Central District’s Attorney Admission Fund provides essential funding to pro bono organizations serving self-represented bankruptcy filers in the Central District.

A new feature in the 2013 report is a collection of maps depicting the distribution of pro se filers, self-help resources, income levels, the Spanish-speaking population, and bankruptcy petition preparers in relation to court locations in the Central District. The maps, prepared by University of California, Los Angeles Ann C. Rosenfield Fellow Julie A. Pollock during her 2013 fellowship, showed how self-represented parties were dispersed throughout the Central District. Cross-referencing United States Census data, the maps also indicate a correlation between the locations of bankruptcy petition preparers and concentrations of Spanish-speakers in the Central District.

The 2013 pro se report shows that the marked decline in total bankruptcy filings, resulting in cuts to the Court’s budget in recent years, has been accompanied by only a comparatively slight decrease in the rate of pro se filings. This underscores the continuing need to address self-represented parties and to do so more efficiently with a declining number of court staff. By continuing with its reporting efforts and evaluating the data available on self-represented parties, the Court may target its resources toward communicating with underserved communities about free and low cost resources before needy individuals spend too much or are defrauded when seeking bankruptcy assistance.

Mediation Program

The Court established its Bankruptcy Mediation Program in 1995 to provide the public with effective and reliable assistance in resolving disputes without the time and expense associated with litigation. The mediation panel consists of attorneys and non-attorney professionals such as accountants, real estate brokers, physicians, and professional mediators, and in 2014, had 184 members. The Court continues to add new members on an ongoing basis as mediators who have joined the panel in 1995 retire. The Mediation Program entered in its 19th year in 2014 and remains the largest and most robust bankruptcy mediation program in the nation.

From the program's inception in 1995 through the end of 2014, the judges assigned 5,310 matters to mediation. 4,573 of those matters concluded and 2,905 of the concluded matters were settled. The settlement rate has held steady over the years at a very impressive rate of 63 percent.

Internal Controls and Audits

On an annual basis, the Court conducts a self-assessment of internal controls to ensure compliance with policies promulgated by the Administrative Office of the U.S. Courts (AO) and the Court itself. The intended purpose of this review is to examine and provide an objective analysis of each department’s operations in an effort to help management improve efficiency, ensure good stewardship, and maintain effective financial controls. This review is essential in safeguarding the public’s trust.

In 2014, the Clerk’s Office conducted a self-assessment for the following areas:

- Financial Management

- Procurement

- Property Management

- Human Resources

- Information Technology/Security

- Operations (All Divisions)

Bar Advisory Board Provides Vital Input

The Court’s Bar Advisory Board was initially formed in 2009 and meets quarterly with the Chief Bankruptcy Judge, other interested judges, and the Executive Officer/Clerk of Court. The 2014 members of the Bar Advisory Board included: Peter Anderson, U.S. Trustee; Jeff Krieger, Los Angeles County Bar Association, Commercial Law and Bankruptcy Section; Andrew Goodman, San Fernando Valley Bar Association, Business Law and Bankruptcy Section; Keith Higginbotham, Central District Consumer Bankruptcy Attorney Association (cdcbaa); Marjorie Johnson, Inland Empire Bankruptcy Forum; Theodore A. Cohen, Los Angeles Bankruptcy Forum; Chris Minier, Orange County Bankruptcy Forum; and Anerio Altman, Orange County Bar Association, Commercial Law and Bankruptcy Section.

The Bar Advisory Board provides a conduit for the Court to disseminate information to the bar and obtain feedback on various issues of mutual concern. In 2014, the Bar Advisory Board members provided substantial input from their respective bar associations in response to the Court’s request for ideas to improve court operations. The exercise resulted in numerous ideas and suggestions involving practices and general case management issues. Many of the suggestions were adopted by the Court, and in one instance, submitted to the Administrative Office of the U.S. Courts (AO) for national consideration and subsequent implementation. The Bar Advisory Board also recruited volunteers from the local bar to assist in the Court’s effort to update its standards for chapter 7 limited scope of appearance in light of In re Seares.

Changes to Federal Court Miscellaneous Fee Schedule

The Judicial Conference of the United States approved changes to the federal court miscellaneous fee schedules. Beginning June 1, 2014, the filing fees for bankruptcy petitions are as follows: chapter 7, $335; chapter 9, $1,717; chapter 11, $1,717; chapter 12, $275; chapter 13, $310; and chapter 15, $1,717. The filing fee for a complaint is $350. Effective December 1, the miscellaneous fee schedule was also updated to include a $25 fee for filing a motion to redact a previously filed document, and a $207 fee for authorization of direct appeal (or cross appeal) from a bankruptcy court to a court of appeals. Public Notices were issued for both fee schedule changes.

To reflect these changes, the Clerk's Office updated its cashiering system, the Court's Abbreviated Fee Schedule, and references to the fees in the Court Manual.

PACER Change Temporarily Affects Access to Los Angeles Cases Closed Prior to 2001

On August 11, 2014, the Public Access to Court Electronic Records (PACER) Service Center made a change to the PACER architecture in preparation for the implementation of the Judiciary’s Next Generation (NextGen) Case Management/Electronic Case Files (CM/ECF). When fully implemented, NextGen will provide improvements for users including a single sign on for PACER. As a result of this change, Los Angeles Division cases closed prior to February 1, 2001 were temporarily in accessible through PACER. Information regarding these cases remained available free of charge by calling the Court’s toll-free Call Center or using the online chat feature. Such information included debtor name, address, attorney of record, case number, case opening date, case closed date, disposition (e.g., dismissed or discharged), trustee, etc., and is identical to the information about these cases that was previously available through PACER. All Los Angeles Division cases closed on or after February 1, 2001 remained on PACER, as were many earlier case records from divisions other than Los Angeles. By the end of December 2014, the Court’s programmers, in collaboration with the Administrative Office of the U.S. Courts (AO), restored PACER access to the Los Angeles cases closed prior to February 1, 2001.

Changes to National Bankruptcy Forms Implemented

The Court substantially updated its Local Bankruptcy Rules (LBRs) forms for Relief From Stay (RFS). To draft the RFS forms, the Court’s Rules Committee formed the Bar Rules Advisory Group (BRAG), a group of volunteer attorneys from throughout the Central District that represented both debtors and creditors. Some elements of the Court’s RFS extraordinary relief attachment forms were incorporated into the updated RFS forms, and the RFS extraordinary relief attachment forms were retired. The Court’s chapter 11 disclosure statement and chapter 11 plan forms were updated to refer to exhibits that are produced using a new exhibit worksheet in Excel format. The Excel spreadsheet includes macros to standardize and simplify the process of creating the exhibits. The Court also began the process of renumbering its local “Other” forms with LBR numbers tied to applicable LBRs. Additional new and revised forms were introduced in June and December 2014.

Employment Dispute Resolution Plan Amended

On March 17, 2014, the Court’s Employment Dispute Resolution (EDR) plan was amended to extend whistleblower protection to employees of the Judiciary. The Federal Judiciary provides communication channels through which court employees may report violations of law or suspected fraud, waste, abuse, or mismanagement of funds by employees or by entities doing business with the Court (known as “whistleblowing”). However, until now, the Judiciary did not provide a specific remedy for employees who face adverse personnel actions as a result of whistleblowing, such as that provided to Executive Branch employees in the Whistleblower Protection Act of 1989, 5 U.S.C. § 2302 (b)(8). The amended plan was communicated to all employees and a special section of the Intranet was deployed to house the procedures and forms.

AO Features Court Strategic Plan on JNet

The Administrative Office of the U.S. Courts (AO) featured the Court’s Strategic Plan for 2014 – 2019 on the JNet as a model long-range plan for bankruptcy courts. Along with the strategic plans of the bankruptcy courts for the District of Maryland and the Southern District of New York, it is one of three such models featured on the website.

Central District Continues Archiving Project

The Los Angeles and Northern Divisions continued to archive records to free up valuable space. Included in the shipment from the Los Angeles and Northern Divisions to the National Archives and Records Administration were 480 boxes of closed cases and adversary proceedings and 27 boxes of audio recordings of court proceedings.

Additionally, the Los Angeles, San Fernando Valley, and Northern Divisions shredded 1,460 boxes of petitions, subsequent documents, claims, financial records, paper documents, old transcripts that were already disposed of by Federal Records Center, and miscellaneous folders. Along with these paper records, the Court was able to dispose of shelving units, storage boxes, and file cabinets, significantly increasing the total volume of storage space.

Court Staff Members Receive Awards from U.S. Probation Office

On August 27, 2014, Executive Officer/Clerk of Court Kathleen J. Campbell, Space Planning/Office Services Manager Roland Blanco, and Administrative Specialist Anthony Gomez were invited to attend the U.S. Probation Office’s 2014 awards and recognition ceremony, held at the Autry Museum in Griffith Park.

On August 27, 2014, Executive Officer/Clerk of Court Kathleen J. Campbell, Space Planning/Office Services Manager Roland Blanco, and Administrative Specialist Anthony Gomez were invited to attend the U.S. Probation Office’s 2014 awards and recognition ceremony, held at the Autry Museum in Griffith Park.

The event was presided over by Chief U.S. Probation Officer Michelle A. Carey and attended by more than 200 U.S. Probation employees and guests, including Senior District Judge Terry J. Hatter, District Executive and Clerk of Court Terry Nafisi, and Chief Pretrial Services Officer George Walker.

Office Services Manager Roland Blanco and Administrative Specialist Anthony Gomez each received an administrative award in recognition of their dedication and partnership in advancing the goals, mission and values of the U.S. Probation Office. Over the years, the Court has maintained a solid relationship with the U.S. Probation Office by assisting them with facility lease negotiations, space and facilities projects, and most recently, by helping them reduce costs by providing them with space and facilities to use for their ongoing officer training program. This cost-saving effort was a key factor in the Court’s selection for these administrative awards and the recognition was most appreciated.

Supreme Court Oral Argument Broadcast to Court Staff

On January 24, 2014, the Court broadcasted an audio recording of oral argument in the U.S. Supreme Court to court staff in all five divisions. A case originating in Judge Thomas B. Donovan’s courtroom, Law v. Siegel, was heard by the Supreme Court to determine whether there Judge Thomas B. Donovan are circumstances in which certain exempt property that is generally protected under the Bankruptcy Code can be used to pay administrative expenses of the estate. Judge Donovan provided introductory remarks and took questions at the conclusion of oral argument.

Bankruptcy Case Timeline

University of California, Los Angeles Ann C. Rosenfield Fellow Julie A. Pollock worked with the Court’s Pro Se Committee to develop a timeline that identifies and explains the major events and deadlines that occur in a chapter 7 bankruptcy case. The Bankruptcy Timeline Julie A. Pollock was originally developed and formatted to be distributed as a PDF document. In December 2013, the Bankruptcy Timeline appeared on the “Don’t Have an Attorney” page of the Court’s website. Working with the Clerk’s Office to create a better visual tool, Ms. Pollock helped to develop an interactive web version of the Bankruptcy Timeline. In January 2014, a promotional component was added to the Court’s homepage and the rotating images now prominently display and link to the interactive version of the Bankruptcy Timeline. An analysis of the Court's website revealed it is one of the most popular links visited. The timeline was expanded by adding a Spanish version in March 2014, in both the PDF and interactive versions.

University of California, Los Angeles Ann C. Rosenfield Fellow Julie A. Pollock worked with the Court’s Pro Se Committee to develop a timeline that identifies and explains the major events and deadlines that occur in a chapter 7 bankruptcy case. The Bankruptcy Timeline Julie A. Pollock was originally developed and formatted to be distributed as a PDF document. In December 2013, the Bankruptcy Timeline appeared on the “Don’t Have an Attorney” page of the Court’s website. Working with the Clerk’s Office to create a better visual tool, Ms. Pollock helped to develop an interactive web version of the Bankruptcy Timeline. In January 2014, a promotional component was added to the Court’s homepage and the rotating images now prominently display and link to the interactive version of the Bankruptcy Timeline. An analysis of the Court's website revealed it is one of the most popular links visited. The timeline was expanded by adding a Spanish version in March 2014, in both the PDF and interactive versions.

Court's Fee Waiver Pilot for Pro Bono Attorneys Expands

Under the direction of the Case Management Committee, the Court expanded its Case Management/Electronic Case Files (CM/ECF) fee waiver pilot program in April 2014. Initially launched in June 2013, the pilot enables pro bono attorneys to electronically file fee waiver applications along with case commencement documents. The program was suggested by the Bar Advisory Board as part of an effort to encourage attorneys to volunteer to provide pro bono services to pro se debtors by streamlining the process, avoiding an in-person visit to the Clerk’s Office.

Petition Package Substantially Updated

A project team comprised of operations staff and the Forms Task Force updated the Court’s chapter 7, 11, and 13 petition packages to reflect changes in automation and the Court Manual. The team solicited suggestions from pro bono attorneys at the Los Angeles self-help desk about making the instructions easier to understand for pro se debtors. The updated petition packages will include the optional Debtor Electronic Bankruptcy Noticing (DeBN) Activation form to enable debtors to request receipt of orders and court-generated notices by email rather than by U.S. mail. The updated petition packages were made available in the summer of 2014.

Modified Case Initiation Action Notice Procedures Implemented

On June 23, 2014, the Clerk’s Office implemented the modified Case Initiation Action Notice (CIAN) procedures that were approved by the Case Management Committee and adopted by the Court at the Board of Judges meeting held on December 6, 2013. CIANs are used by court staff to identify issues related to non-deficient case commencement documents and provide this information to the presiding judge. To prepare for the rollout, the Clerk’s Office conducted comprehensive staff training and extensively modified Case Management/Electronic Case Files (CM/ECF) and local Case Commencement Deficiency Notice (CCDN) procedures. The procedures were revised to reduce the number of CIANs sent to chambers for handling, and to clarify that once a CIAN has been sent to chambers, chambers staff were responsible for preparing any orders or taking whatever action the judge deemed necessary or appropriate. The uniformity of the revised procedures saves labor for the Clerk’s Office and the district-wide uniformity of the CIAN enables staff members throughout the Central District to assist other divisions when necessary.

AO Supplemental Funding for the Records Digitizing Project and Document Processing Received

As part of the Roybal Realignment Project and in an effort to reduce the Court’s footprint, the Administrative Office of the U.S. Courts (AO) agreed to provide funding for estimated labor costs for digitizing, scanning, and processing all paper records in the Los Angeles Division. Additionally, in 2014, the Court requested and received supplemental funding for 14 terabytes of additional space to store PDFs for the Records Management Digitizing Project and future projects similar in nature. According to the established records retention schedules, designated Records and Operations staff scanned and converted paper records into digital copies; reviewed case files to be archived; reviewed PDFs of paperless documents; disposed of paper copies by shredding; and reviewed transcripts, exhibits, and miscellaneous case files and documents.

In 2014, the Records team scanned 188 boxes of paper documents for the Administrative Services Department, 119 boxes for the Office Services Department, and 575 boxes for the Executive team, totaling 882 boxes. A total of 443 boxes of closed cases were prepared and transferred to the Federal Records Center. The Records team completed the disposal of 910 boxes of paper documents. These paper documents were scanned, saved as PDFs, and subsequently uploaded into Case Management/Electronic Case Files (CM/ECF) as electronic files.

The Records team also disposed of 130 boxes for the Administrative Services Department. A sum of 379 boxes containing old transcripts that were already disposed of by the Federal Records Center and miscellaneous folders from cases closed in 1997 were disposed of by on-site shredding.

Court Participates in Large Court Workshop on Procurement Issues

On November 4 and November 5, 2014, employees from five of the nation’s largest court units met with representatives of the Administrative Office of the U.S. Courts’ (AO) Procurement Management Division (PMD) to discuss procurement issues affecting large courts. Organized by the U.S. District Court for the Central District of California, the meeting took place in Los Angeles with employees from the following courts: the District Courts for the Southern District of Florida, the Northern District of Illinois, and the Central District of California; Pretrial Services for the Central District of California; and the Bankruptcy Court for the Central District of California.

On November 4, Procurement Executive Carey Fountain kicked off the event with a presentation about the role the PMD plays in the procurement process, and Supervisory Procurement Analyst Donald Parkins enumerated common problems and challenges faced by larger courts. Mr. Fountain and Mr. Parkins emphasized the high level of responsibility and risk large court units undertake in the procurement of goods and services. Mr. Fountain concluded the day’s discussion with a look at initiatives currently underway that will assist court units in streamlining the procurement process in the future. On November 5, Mr. Fountain and Mr. Parkins asked participants about their procurement practices, and IT Manager Theresa Dressler of District Court for the Central District of California presented examples of automated systems used in their court.

Clerk's Office Staff Enrolls in NARA Records Management Training Program

Deputy-in-Charge Dennis Tibayan, Self Help Desk Team Leader Sabrina Palacio-Garcia, Operations Specialist Willy Del Mundo, and Executive Assistant Jessica Garibay were enrolled in the National Archives and Records Administration’s (NARA’s) National Records Management Training Program at the NARA regional facility in San Diego from August 18 through August 22, 2014 and September 15 through September 19, 2014.

The training program included courses in six “Areas of Knowledge” relevant to anyone responsible for managing federal records. NARA offers a certificate in Federal Records Management Training to participants who successfully complete classes two through six in the series and pass exams associated with each class. The “Areas of Knowledge” classes are: “Creating and Maintaining Agency Business Information,” “Records Scheduling,” “Records Schedule Implementation,” “Asset and Risk Management,” and “Records Management Program Development.” The courses associated with the certificate cover every aspect of federal records management and are an important step in acquiring the skills necessary to manage federal records.

The program focuses on policies and procedures unique to the federal environment. The training will aid the Court in maintaining correct and orderly records, complying with federal guidelines for records management, and preparing for emergencies.

Court Staff Attends 2014 NCBC Conference

From July 14 through July 18, 2014, over 450 bankruptcy employees from bankruptcy courts across the country gathered in St. Louis, Missouri to attend the 34th annual National Conference of Bankruptcy Clerks (NCBC) hosted by the U.S. Bankruptcy Court for the Eastern District of Missouri and the U.S. Bankruptcy Court for the Southern District of Illinois. The U.S. Bankruptcy Court for the Central District of California was represented by 28 delegates, including Chief Deputy of Administration Steven A. Sloniker and Officer of Planning and Personnel Management Beryl Dixon.

From July 14 through July 18, 2014, over 450 bankruptcy employees from bankruptcy courts across the country gathered in St. Louis, Missouri to attend the 34th annual National Conference of Bankruptcy Clerks (NCBC) hosted by the U.S. Bankruptcy Court for the Eastern District of Missouri and the U.S. Bankruptcy Court for the Southern District of Illinois. The U.S. Bankruptcy Court for the Central District of California was represented by 28 delegates, including Chief Deputy of Administration Steven A. Sloniker and Officer of Planning and Personnel Management Beryl Dixon.

Attendees experienced an event-filled week that included many educational opportunities and social and networking events, as well as a chance to learn about the city by the Mississippi River, also known as “The Gateway to the West.” Various informative breakout sessions were offered during the week covering topics such as leadership and teamwork lessons from the world of sports; navigating the JNet; negotiating, collaboration, and communication; technical training on Microsoft PowerPoint, Word, and Excel; financial literacy, Thrift Savings Plan and retirement planning; Next Generation (NextGen) Case Management/Electronic Case Files (CM/ECF); and creating a positive work environment. Attending the conference was an educational and valuable experience for all.

This year’s conference marked the 10-year anniversary of NCBC’s partnership with Michigan State University (MSU). NCBC once again offered two courses from the MSU Judicial Administration noncredit certificate program: “Purposes and Responsibilities of Courts” and “Leadership.” At each NCBC annual meeting, MSU offers two different courses as part of its certificate program in the area of judicial administration. Students in the program, including court staff, received educational exposure to the various aspects of court management and administration.