Central District of California - 2012 Pro Se Annual Report

Self-Represented Parties – The Numbers

The total number of debtors seeking bankruptcy protection declined by 21.5 percent in 2012, but the percentage without counsel remained about the same – 27 percent of all debtors as compared to 28 percent of all debtors in 2011 (See Figure 1). The District’s rate of pro se filings remained at over three times the national average of 8.9 percent.

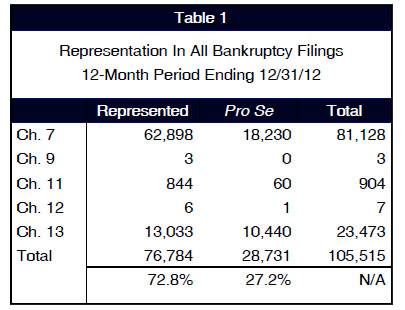

Of the 105,515 bankruptcy cases filed in the District, 28,731, or 27.2 percent, were filed without counsel (See Table 1 below). Chapter 13 petitions had the highest pro se percentage with 44.5 percent, followed by chapter 7 petitions with 22.5 percent. Chapter 11 had the smallest percentage of pro se filings with 6.6 percent (See Figure 2).

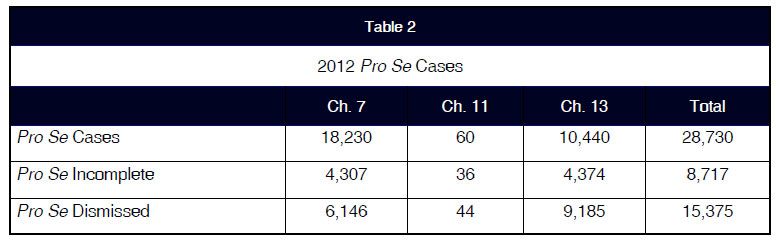

The difference in results where debtors were without counsel was similar in 2012 to what the Court observed in 2011. By all objective measures, and despite significant resources available to these debtors, their cases were dismissed at staggeringly higher rates (See Figure 3).

These dismissals also include cases that were not filed in good faith, and were never intended to make it through to completion. Some of these cases might have been filed solely to gain a temporary automatic stay or otherwise abuse the bankruptcy process. The ability to find more ways to assist good faith debtors in need of proper guidance, but still stop the high volume of abusive pro se filings, continues to challenge court resources.

A significant number of pro se cases are initiated as incomplete filings (See Figure 6), which are especially labor-intensive to process. Incomplete filings, also known as “face sheet filings,” are usually filed without complete schedules or the statement of financial affairs, providing minimal information. Over half of the pro se cases filed in 2012 were dismissed (See Figure 3). This high dismissal rate impacts the Clerk’s Office’s workload, and the dismissals negatively impact the credit records of pro se debtors without providing the benefit of a discharge (See Figure 4).

Attorney filed cases, filed electronically, have a lower initial incomplete rate and a lower dismissal rate. These cases create less work for the Court’s dwindling staff and result in discharges at almost twice the rate of pro se cases (See Figure 5).

The dismissal or discharge rate once a case is filed is not the only metric of “success.” Many debtors just do not need to file bankruptcy. In the Los Angeles Division, Public Counsel’s analysis of its intake data compared to chapter 7 filings shows that only 36 percent of the people seeking guidance at the Los Angeles Self-Help Desk ended up filing bankruptcy.

Table of Contents

- Introduction

- Self-Represented Parties - The Numbers

- Impact from Assistance by Non-Attorneys

- Debtor ID Program

- Bankruptcy Petition Preparer (BPP) Tracking

- Chapter 7 Success

- Chapter 13 Failure

- Burden on Court Staff

- Fraud and Abuse

- Language Barriers

- Professional Involvement in “Pro Se” Fraud Cases

- New Programs and Services for the Self-Represented

- New Website Launched

- Call Center Implemented

- DVD Created for Self-Represented Parties

- Forms and Instructions

- Assistance from Volunteers and Nonprofit Organizations

- Los Angeles Division

- San Fernando Valley Division

- Santa Ana Division

- Riverside Division

- Northern Division

- Recognition

- Fundraising by Pro Bono Organizations for Non-Court Services

- Run For Justice

- Inaugural Leslie Cohen 5K Run/Walk

- Earle Hagen Memorial Golf Tournament

- Los Angeles Holiday Party

- Santa Ana Holiday Party

- Current Projects “Under Construction”

- Conclusion