How Many Self-Represented Parties Are There?

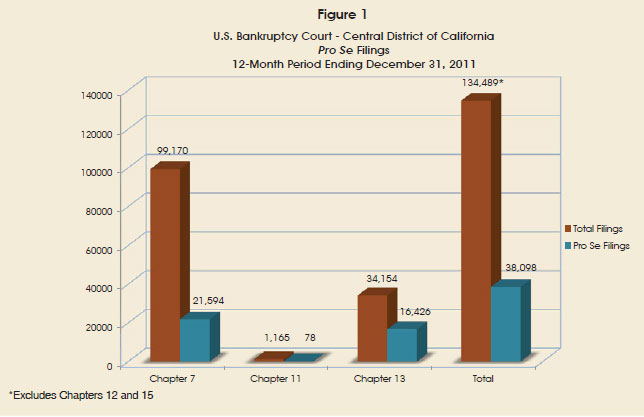

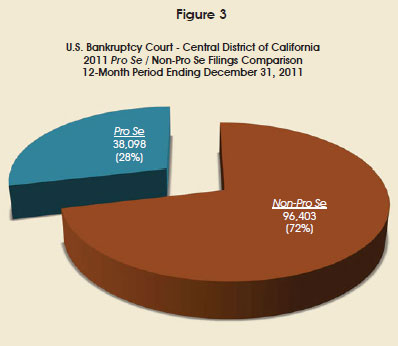

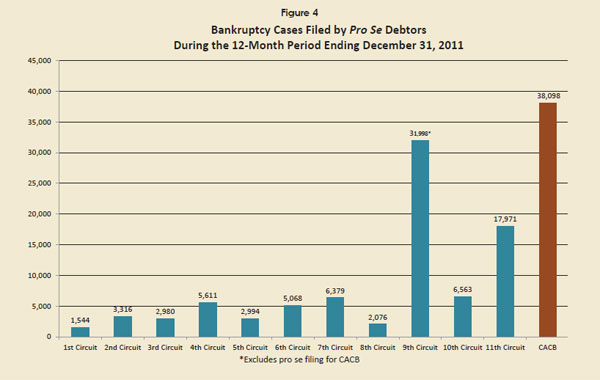

The Central District of California led the nation in bankruptcy filings in 2011 with 134,501 filings. About 28 percent of our filings are filed without an attorney, compared to about 9 percent nationwide. Because the Court’s systems track whether debtors are represented, we know that California Central had 38,098 filings by individual self-represented debtors last year. Because the Court’s systems do not track whether creditors are represented by counsel, we do not know how many creditors file pleadings or appear without counsel. Based on a rough estimate of the number of unrepresented creditors seen in court, at the filing window, and in the self-help clinics, the total number of self-represented parties of all types in 2011 is well over the 38,098 debtors we have recorded, and could easily surpass 40,000.

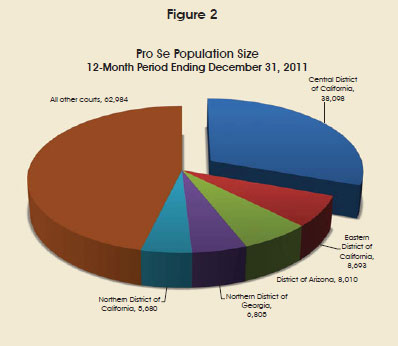

The five districts with the highest pro se bankruptcy filings are:

To put this in some perspective, the Central District of California serves more self-represented parties than any other bankruptcy court. The next highest court is California Eastern with 8,693 pro se filings in 2011. Other courts have generously shared the ideas and programs they use to address their own self-represented populations, and we have adopted many of those elements that might apply locally. Because the solutions we have studied in other federal courts are not always appropriate to address the vast number of self-represented parties in our district, we have also started looking at local state court programs that serve large self-represented populations. For example, up to 90 percent of the family law cases in Los Angeles Superior Court involve at least one self-represented party. Court staff have toured the downtown Los Angeles Superior Court self-help facility to learn about its programs for the self-represented.

The overall percentage of debtors filing without an attorney has steadily increased over the past several years. The weak economy, excessive unemployment, and the continuing foreclosure crisis have made the problem more acute. Pro se filings in the Central District increased to 28 percent in 2011 from 20 percent in 2007. According to Court staff, there has also been an increase in filings by unrepresented creditors.

Table of Contents ( Download Report)

Download Report)

- Introduction

- What Do We Know About Self-Represented Parties in our Court?

- How Many Self-Represented Parties Are There?

- Measuring Success

- Language Barriers

- Bankruptcy Petition Preparers

- Income Levels

- Literacy Issues

- Self-Represented Creditors

- Court Resources and the Impact of Large Numbers of Self-Represented Litigants

- Debtor ID Program

- Current Programs and Services for the Self-Represented

- The Court’s Website

- Personal Assistance from Court Staff

- Easy to Understand Forms and Instructions

- Assistance from Volunteers and Nonprofit Organizations

- Honor Roll

- Recruitment and Training of Volunteers

- Funding Sources for Non-Court Services

- Current Projects “Under Construction”

- Pathfinder Electronic Filing Project

- Proof of Service

- Video Instruction

- Future Surveys

- Call Center/Internet Live Chat

- Goals/Conclusion

- Exhibits