Bankruptcy Petition Preparers

One cannot understand the self-represented population without understanding the role of bankruptcy petition preparers (BPPs). Under 11 U.S.C. §110, non-attorneys are permitted to type bankruptcy forms for debtors according to certain rules detailed in that section. Based on earlier studies, we know that the vast majority of debtors that Court records refer to as pro se are in fact assisted by BPPs. A 2003 study by the U.S. Trustee reported that only 3 percent of debtors filing were truly pro se. The other 97 percent employed either attorneys or BPPs to file. At the time of the study, 23 percent of all debtors used a BPP to file. This may have changed recently due to the presence of self-help desks in every division. Court forms and rules require BPPs to disclose their involvement, but the Court has reason to believe that approximately half of them fail to do so.

Based on interviews with debtors, motions brought by the U.S. Trustee, and reports from volunteer attorneys at the self-help desks, we know that many debtors rely almost completely on BPPs to tell them what to do in the case. The BPP frequently advises which chapter to file, which exemptions to choose, which forms to fill out, and when to file. When a debtor files bankruptcy in pursuit of a specific outcome, such as preventing a foreclosure or stopping a wage garnishment, it is frequently on the advice of a BPP. In essence, the debtors believe themselves to be “represented” by the BPP regardless of what warnings are posted, disclosures signed, or lack of legal degree obtained. Thus, the term “self-represented” (or pro se) is largely a misnomer in practical terms. The Court also must address this de facto “representation” by BPPs if it is to address access by parties not represented by attorneys.

Though some BPPs in the district get good results for debtors, some practice outright fraud. While this has long been the case in the district, the prevalence of “foreclosure assistance” and “loan modification” scams has increased with the foreclosure crisis in the last few years. The incidence of BPPs either ignoring the requirements of §110 or committing fraud has increased as well. The challenge is sorting out the abusive and fraudulent activities from legitimate ones.

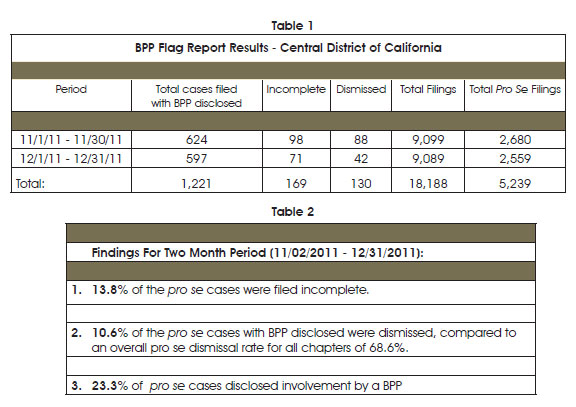

The national CM/ECF case management system tracks attorneys’ names but does not track either BPPs’ names or their involvement in the case, even where it is disclosed. BPPs’ involvement can only be ascertained through a case-by-case docket review. In an effort to track the disclosed BPPs, the Court implemented a system late last year to flag those cases that list a BPP. Through this new flagging procedure, we have determined that 1,221 cases were filed in November and December with the assistance of a BPP disclosed. As there were 5,239 pro se cases filed in November and December, at least 23 percent of the “self-represented” cases were BPP-assisted. Because many BPPs do not disclose their involvement, this is an underestimate of how many pro se cases are actually BPP “represented.” It does, however, give us a limited ability to measure the BPP cases in our self-represented population going forward.

Based on the information brought to the Court’s attention through the Debtor ID Program, discussed later in this report, and U.S. Trustee motions under §110, many of the BPPs are charging debtors anywhere from $400 to $1,500. Many of these debtors would qualify for free legal representation or could have filed the case themselves with the assistance of the self-help desks; some could have retained counsel for what they paid the BPP. On the other hand, a number of BPPs indeed charge $200 or less, complete all forms appropriately, and see debtors through to discharge.

Without better disclosure, it is not possible to determine how many BPP-assisted cases are successful, or the fee charged. Because 60% of the self-represented cases do receive a discharge, and many of these are BPP assisted, some of the BPP cases are a cost effective alternative for some debtors. It would be helpful for the Court to know more about BPP-assisted cases in order to know how many debtors are actually self-represented, how many may be paying too much, and how many are involved in fraud and abuse. The BPP flag system and Debtor Identification Project, discussed later in this report, will allow us to gather better information in order to understand this group of cases.

One aspect of the challenge of encouraging debtors to consult counsel, rather than BPPs, is the prevalent advertising for notarios in California. The cultural understanding of a notary’s role in the North and Central American communities here complicates the distinction between attorneys and BPPs. In many parts of Central America, a notario has legal training and may lawfully prepare various legal documents without attorney supervision. A notary’s function is, of course, much more restricted in the United States, but many immigrants do not know this. This leads to rather common and prevalent unlicensed practice of law by BPPs advertising themselves as notarios.

Table of Contents ( Download Report)

Download Report)

- Introduction

- What Do We Know About Self-Represented Parties in our Court?

- How Many Self-Represented Parties Are There?

- Measuring Success

- Language Barriers

- Bankruptcy Petition Preparers

- Income Levels

- Literacy Issues

- Self-Represented Creditors

- Court Resources and the Impact of Large Numbers of Self-Represented Litigants

- Debtor ID Program

- Current Programs and Services for the Self-Represented

- The Court’s Website

- Personal Assistance from Court Staff

- Easy to Understand Forms and Instructions

- Assistance from Volunteers and Nonprofit Organizations

- Honor Roll

- Recruitment and Training of Volunteers

- Funding Sources for Non-Court Services

- Current Projects “Under Construction”

- Pathfinder Electronic Filing Project

- Proof of Service

- Video Instruction

- Future Surveys

- Call Center/Internet Live Chat

- Goals/Conclusion

- Exhibits