Measuring Success

Does it actually matter if a litigant has an attorney? Anecdotally and experientially, those working within the bankruptcy system know how vital proper legal representation is. Because we see so many parties harmed by the lack of representation, the bankruptcy bar and the Court have spent years developing pro bono programs, developing attorney referral resources, and trying to find legal advice for as many people as possible. After years of such efforts, with an increasing pro se rate, we must reluctantly conclude that personalized legal representation for each litigant is an unrealistic goal. More precise targeting of Court services and pro bono assistance is needed to address the population, who, for whatever reason, will not retain an attorney.

Common problems in self-represented debtors’ cases include: the failure to file required documents, resulting in dismissal; filing a chapter which may not be correct for the debtor’s circumstances; choosing incorrect property exemptions; unnecessarily filing bankruptcy in the first place; not filing the required credit counseling or financial management certificate; being unable to answer or adequately defend an action seeking to deny discharge; and not understanding the significance of certain motions or adversary actions. Self-represented creditors are often harmed by not filing a proof of claim in time, by missing the deadline to file a dischargeability action, and having difficulty filing an objection to a claim.

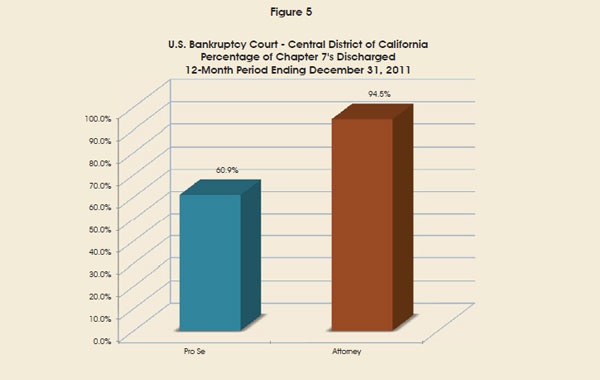

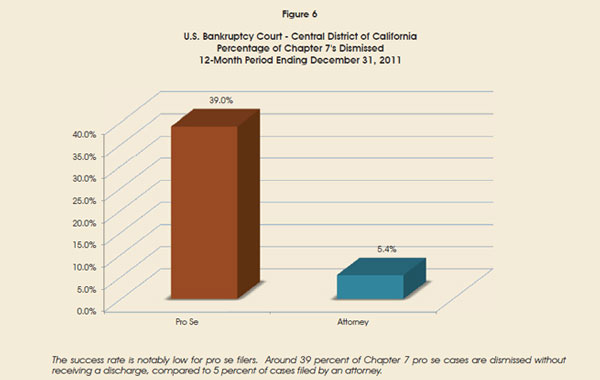

While we cannot measure the precise effect of a lack of legal representation in individual cases, our Court has evaluated the results in self-represented cases in aggregate. A chapter 7 bankruptcy—generally, the easiest type of bankruptcy available—should result in a discharge of debts. Using this basic measure of success, a self-represented debtor in chapter 7 will obtain a discharge of debt only approximately 61 percent of the time in this district, compared to the much more favorable 95 percent discharge rate of attorney-represented chapter 7 cases.

On the other hand, well over half of all self-represented debtors do obtain a discharge of their debts without retaining counsel. While we know that some of these debtors fail to list all creditors or all assets, especially causes of action, this occurs in attorney-represented cases as well.

Many pro se debtors seek the protection of the automatic stay to forestall events such as imminent home foreclosures. In their haste to file in order to implement the stay, debtors without counsel may file a chapter which is not appropriate for their situation, or they may neglect to file the correct papers or meet the necessary deadlines for filing schedules. Such errors and miscalculations often result in the dismissal of self-represented cases, which can have serious ramifications. Once a debtor’s case is dismissed, the automatic stay will frequently not be in place in subsequent filings. Then, even if the debtor figures out how to file correctly, he or she might be surprised by a foreclosure or vehicle seizure that could have been prevented.

Chapter 13 is typically considered the chapter of choice for those wage-earners seeking to catch up on missed car or house payments and avoid repossession of a vehicle or foreclosure of a home. Confirmation of the chapter 13 plan that provides for payment of such arrearages over many months is necessary to begin the process of making up for missed payments. Completion of a chapter 13 plan through discharge can take 36 to 60 months, and is very difficult to achieve even in attorney-represented cases. Approximately 55 percent of attorney-represented cases reach confirmation. The number of self-represented debtors that manage to get to confirmation of a chapter 13 plan is 0.4 percent – clearly demonstrating that it is nearly impossible for this population to succeed in chapter 13.

One piece of this picture we are unable to determine from dismissal and discharge rates is how debtors filing bankruptcy define “success.” We know from individual cases that many of these debtors never planned on completing the requirements that would lead to a discharge of debts. We do not know whether some would have proceeded differently had they been advised by competent counsel. Public Counsel reports that the majority of visitors to the Los Angeles Self-Help Clinic ended up not filing bankruptcy once they better understood their options and recognized that bankruptcy was not the appropriate solution for their issue. Bet Tzedek Legal Services provided similar feedback that visitors chose not to file after having the opportunity to receive counseling from an attorney. Finding out more about the 39 percent of self-represented chapter 7 cases that are dismissed, and the nearly 100 percent of self-represented chapter 13 cases that are dismissed, would allow us to better identify abusive or fraudulent filings and reach out to those who just need better legal assistance.

Table of Contents ( Download Report)

Download Report)

- Introduction

- What Do We Know About Self-Represented Parties in our Court?

- How Many Self-Represented Parties Are There?

- Measuring Success

- Language Barriers

- Bankruptcy Petition Preparers

- Income Levels

- Literacy Issues

- Self-Represented Creditors

- Court Resources and the Impact of Large Numbers of Self-Represented Litigants

- Debtor ID Program

- Current Programs and Services for the Self-Represented

- The Court’s Website

- Personal Assistance from Court Staff

- Easy to Understand Forms and Instructions

- Assistance from Volunteers and Nonprofit Organizations

- Honor Roll

- Recruitment and Training of Volunteers

- Funding Sources for Non-Court Services

- Current Projects “Under Construction”

- Pathfinder Electronic Filing Project

- Proof of Service

- Video Instruction

- Future Surveys

- Call Center/Internet Live Chat

- Goals/Conclusion

- Exhibits