Introduction

Foreword

Message from Hon. Maureen A. Tighe, United States Bankruptcy Judge, Central District of California

Chair, Pro Se Resources Committee

Although total case filings have dropped dramatically in the last few years, the percentage of debtors who represent themselves remains constant. This report reviews the outcome of self-represented cases and compares them to results seen in attorney-represented cases. Chapter 13 debtors who represent themselves fail at a much greater rate than either attorney-represented chapter 13 debtors or self-represented chapter 7 debtors. Chapter 13 trends are therefore more closely examined this year than in past reports.

Once again, you will see the extraordinary efforts made by our pro bono partners and volunteers. Their efforts provide essential services to economically vulnerable people who otherwise would not have adequate access to the Court. These efforts provided 6,780 people last year with necessary legal advice and representation. The ability to provide access to the Court expanded in 2014 through the addition of a clinic in the Coachella Valley, online chat functions and a free Internet-based petition preparation program.

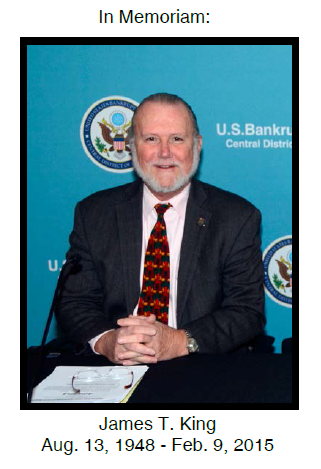

Low-income debtors lost one of their biggest champions, and our court lost one of its kindest advocates shortly after 2014 came to a close. James T. King, a dedicated consumer bankruptcy attorney and a tireless pro bono volunteer, lost his battle to cancer on February 9, 2015. Jim helped with many projects at the court to increase access to justice. He began by volunteering to represent low income debtors through the Los Angeles County Bar Debtor Assistance Project. Later, Jim’s assistance was invaluable in developing bankruptcy self-help clinics in the district. Jim was instrumental in establishing the Earle Hagen Memorial Golf Tournament seven years ago, the proceeds from which continue to increase the funding for pro se resources. We will all miss him terribly. This report is dedicated to Jim, a true warrior for access to justice.

About This Report

This report includes a lot of numbers summarizing what happened in cases, how many pro bono volunteers there were, and how many litigants received assistance. These summaries, unfortunately, do not enable the Court to measure the success of the access to justice programs in the district. The numbers provide a piece of the puzzle, but causation between pro bono or self-help services and “success” in a given case is not possible to study in any reliable or extensive way. An increase or decrease in the pro se level does not tell us whether those who filed needed to file or whether they filled out the many required forms correctly. The filing and pro se numbers are tied to many factors that cannot be measured. Even the numbers explaining dismissal and discharge rates do not tell us if the debtor was still able to save a home or a car, or whether there were non-dischargeable debts they did not realize would still be with them. We do know that 6,780 individuals who believed they could not afford counsel received legal advice from knowledgeable bankruptcy attorneys instead of turning to unlicensed petition preparers, random Internet advice or worse. We know from previous studies that many of these people also did not file bankruptcy after learning more. If they did choose to file, they were more likely to file the correct chapter, be aware of what a filing could and could not successfully address, and to actually obtain a discharge of debts.

The details gathered in this report may provide more information for academic professionals and others to evaluate self-represented parties in bankruptcy. We need to know much more about how to adequately address self-represented litigants in the bankruptcy courts. With the limited knowledge we do have, the Court’s goal is to provide proper access for all parties, whether represented or not. Our case filing system is limited in what reports it can produce, and the following section provides the only “hard data” available at this time to learn how self-represented debtors fared in 2014. It will be instructive to see whether broader access to both Electronic Self- Representation (eSR) and Debtor Electronic Bankruptcy Noticing (DeBN) will increase successful outcomes for pro se debtors. While the ultimate goal is to have pro se debtors find quality bankruptcy attorneys to represent them, improving electronic access to the Court for pro se debtors enables them to better manage their cases on their schedule – helping to bridge the gap in access to the Court between represented parties and pro se debtors.