Appendix

Los Angeles Division

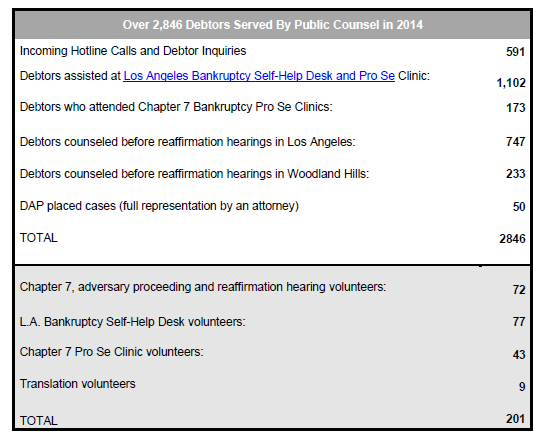

In 2014, the Los Angeles Division was served by several pro bono organizations including Public Counsel’s Debtor Assistance Project (DAP), Bet Tzedek Legal Services, and the Legal Aid Foundation of Los Angeles. In the following sections, a summary of the number of visitors served accompanies each organization.

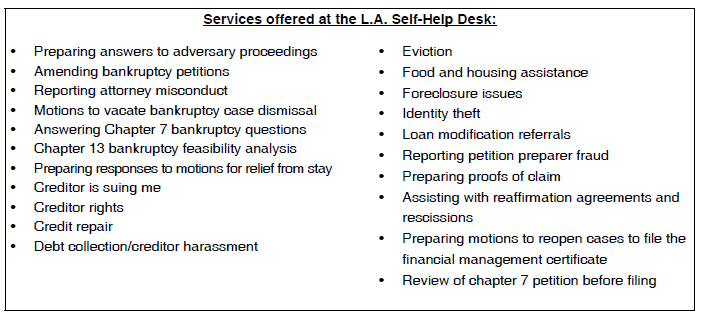

Self-help information and materials are coordinated district-wide through Public Counsel’s Debtor Assistance Project (DAP). The DAP began as the Court’s first effort to make pro bono programs available to the public within its jurisdiction, and has become the umbrella committee and resource for projects for all self-represented parties throughout the District.

Despite its name, the DAP addresses the needs of self-represented creditors as well as those of debtors. Each participating nonprofit organization serves its dedicated clientele, but all self-help desks using Court space must provide service to any party who visits the Court.

The DAP holds bi-monthly meetings at the Court, bringing together representatives of public interest law firms, volunteer attorneys, chapter 7 and 13 trustees, bankruptcy judges, the Clerk’s Office, and the Office of the U.S. Trustee. The DAP raises funds for and awareness of its programs, provides training for pro bono attorneys, and exchanges information on trends and issues related to providing pro bono and self-help assistance, as well as best practices.

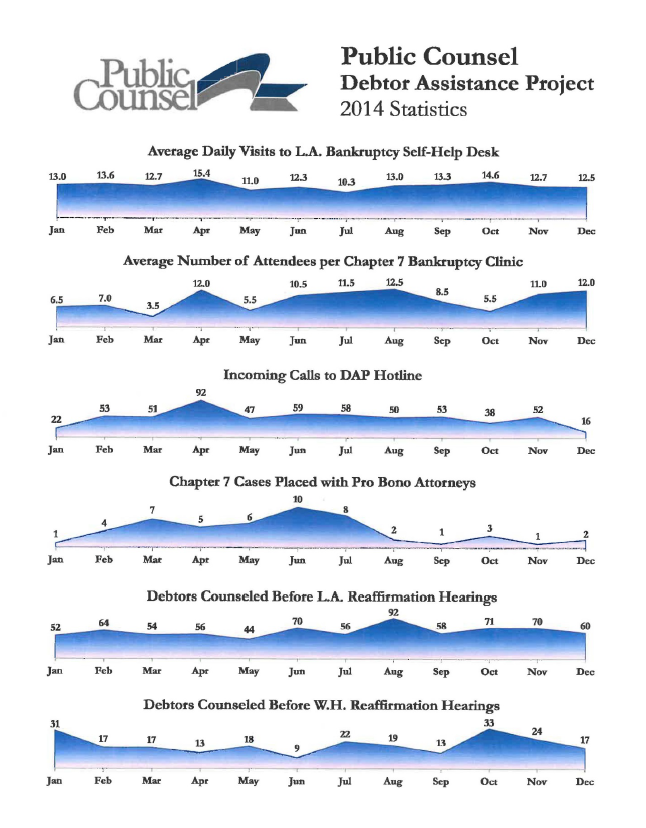

At the December 2014 DAP meeting, Public Counsel Supervising Senior Staff Attorney Magdalena Reyes Bordeaux reported that the numbers served at the Los Angeles Self-Help Desk had significantly dropped. In 2014, Public Counsel assisted approximately 56 percent of the number of debtors it assisted at Reaffirmation hearings, as compared to 2013. The decreased number of visitors made case placement easier to complete, although the number of complex cases increased.

General Overview of Reaffirmation Program in Los Angeles and Woodland Hills

Public Counsel and pro bono volunteers counsel clients before reaffirmation hearings at the bankruptcy courts in Woodland Hills and Downtown L.A. about the pros and cons of signing reaffirmation agreements, mainly for vehicle loans. Volunteer attorneys find their pro bono volunteer contributions to be very rewarding as people often come to the hearings worried that they are going to lose their cars. After volunteers counsel them, they are usually much more relieved, and in most cases can keep their cars if they have complied with the requirements of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA), and the client is current on both the loan and insurance.

As of 2014, the volume of reaffirmation hearings each month had subsided in both divisions along with the reduction in chapter 7 filings. In the Los Angeles Division, there were approximately 50-60 matters on calendar (mostly on vehicles and some real property). In the San Fernando Valley Division, there were 25-35 matters on calendar (mostly on vehicles and real property, as well). The programs are very similar in both divisions, but there are a few differences noted below.

Los Angeles

The program in Los Angeles takes place once a month and the date and location of the hearings rotate each month. Public Counsel receives a six-month calendar for hearings set for the following six-month period. Participation in the program is voluntary by bankruptcy judges in the Los Angeles Division and there are judges in this division who “opt out” of the program and hear reaffirmations as part of a regular calendar where no volunteers are present.

When Public Counsel receives the calendar, they solicit volunteers for the program and work with the Court to coordinate the logistics of rooms, check-in tables, and conference rooms for that day at least a week in advance of the hearing. Public Counsel has reported the logistical assistance provided by the Court has been very helpful at these hearings, especially when there is a large calendar.

The Court gives notice to debtors appearing at the hearings and advises them to arrive an hour prior to their scheduled hearing to receive counseling. On the day of the hearings, there are typically five to six volunteers available to counsel debtors and each judge has their own procedure regarding how they would like to handle the reaffirmation hearings. For example, some judges will wait until all debtors have been counseled before they start the calendar, while other judges prefer to start on time and make general announcements before allowing uncounseled debtors to obtain individual counseling from a volunteer attorney.

Public Counsel trains all new volunteers by giving them materials in advance of the program and also having them shadow an experienced attorney on their first day. In addition, Public Counsel provides volunteers with parking information so that they will be able to find affordable parking in the surrounding area. Public Counsel also encourages new volunteers to stay and observe the hearings so that they can see what a difference their counseling makes for the judge and for the client. After a debtor is counseled by a volunteer, the reaffirmation hearing moves more quickly and is accompanied by less back and forth between the judge and the debtor when a reaffirmation agreement is denied.

Woodland Hills

The reaffirmation clinic program in Woodland Hills (San Fernando Valley Division) is scheduled for a specific date every month. On the third Tuesday of the month, the San Fernando Valley Division bundles the reaffirmation hearings of all of the judges in the Division. In this Division, there is also a comparatively small calendar and there are usually more than enough volunteers to counsel debtors at the hearings. Given that the parking at the San Fernando Valley Division is free, volunteers may be less discouraged to participate than at the Los Angeles Division where parking fees are borne by volunteers.

Attorney Feedback

Attorneys really enjoy this program because the time commitment is limited and it provides them with hands on experience with counseling debtors. Public Counsel also provides malpractice coverage to all of their pro bono attorneys. This has never been an issue, but Public Counsel advises all of their pro bono attorneys about this in advance.

Bankruptcy Basics MCLE

Fifty-nine attorneys and support staff attended a three-hour Bankruptcy Basics training on August 7, 2014 for MCLE credit. The training covered the nuts and bolts of chapter 7 bankruptcy. The following topics were included: the client interview; preparing and filing the petition; preparing for the meeting of creditors; and issues that may arise after the meeting of creditors.

Settlement Agreements MCLE Program

Fifty-four attorneys came to a three-hour Settlement Agreements program on November 4, 2014 for MCLE credit. The panelists reviewed the fundamentals of settlement agreements for bankruptcy and state court, from the perspective of plaintiff’s counsel and defense counsel.

Funding sources supporting Public Counsel programs are discussed elsewhere in this report and include the following: the Attorney Admission Fund; Earle Hagen Memorial Golf Tournament; Leslie Cohen Law 5K; Run for Justice; Los Angeles Bankruptcy Forum Holiday Party; Mr. C’s Annual Holiday Party; and the California Bankruptcy Forum.

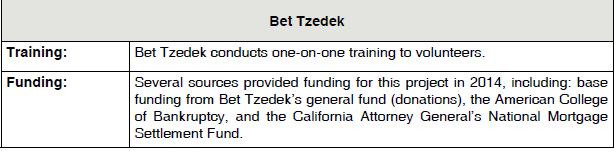

Bet Tzedek

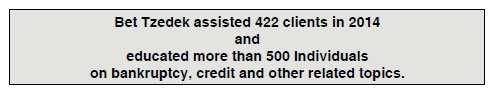

In 2014, nine volunteers assisted Bet Tzedek’s Debtors’ Rights and Bankruptcy Project, including one full-time attorney working through the Berkeley Law Public Interest Fellowship program. Project staff also worked closely with the advocates and dozens of volunteers assigned to Bet Tzedek’s Community Outreach Project. Project volunteers conducted one-on-one client interviews, reviewed financial documents, prepared chapter 7 bankruptcy petitions, wrote letters to creditors and collectors, helped clients respond to bank levies and wage garnishments, and assisted victims of identity theft. Volunteers also helped clients understand and exercise their rights under the fair debt collection laws, review and correct credit reports, and respond to judgment enforcement actions. Volunteers evaluated each visitor’s circumstances and, when appropriate, filed chapter 7 bankruptcy petitions in the Los Angeles and Woodland Hills Divisions. On a more limited basis, clients were given assistance on debts resulting from identity theft, government offsets from public benefits and lastly, student loan discharge applications.

Bet Tzedek also played a key role in securing the California State Bar’s ethics opinion which concluded that it is not a conflict of interest for lawyers and firms who represent banks and other businesses who provide credit, to represent individuals in simple, no-asset chapter 7 bankruptcies. This opinion clears the way for thousands of California attorneys to provide pro bono assistance to debtors without jeopardizing their own practices. See Cal 2014-191: In Rem Bankruptcy Proceedings at http://ethics.calbar.ca.gov/Ethics/Opinions.aspx.

Bet Tzedek provided representation and/or general counseling on debtors’ rights and bankruptcy to 422 clients. Of those, the majority specifically requested assistance with bankruptcy. For a variety of reasons, the majority of visitors decided not to proceed with a chapter 7 bankruptcy. Reasons that mitigated against filing included; the clients’ age, income and assets made filing unnecessary; filing for bankruptcy would not grant the relief sought; discovery that they were ineligible to file; or waiting to file at a later date could provide a greater benefit. Debtors were assisted at one of six Debtors’ Rights Clinics held at Bet Tzedek’s office, each assisting between 35 and 40 people. Those who sought assistance but were not able to attend a clinic were referred to an outreach site for a one-on-one consultation. The outreach sites included senior centers throughout Los Angeles County, St. Francis Medical Center, St. Vincent Medical Center, and SOVA food pantries. In 2014, Bet Tzedek also introduced a new presentation for the community titled “How to Protect and Improve Your Credit.” Overall, Bet Tzedek provided bankruptcy/debtor rights’ educational services to more than 500 individuals. This was all accomplished even while bankruptcy assistance was closed during the final months of the year while staff was on leave.

Legal Aid Foundation of Los Angeles

The Legal Aid Foundation of Los Angeles (LAFLA) is a Legal Services Corporation funded organization. In 2014, LAFLA participated in Loyola Law School’s bankruptcy practicum. The course was taught by Erik Clark and Barry Borowitz. With the help of five law students and three LAFLA staff, twenty clients were provided pro bono assistance with completing their bankruptcy petitions. Unfortunately, LSC funding has steadily decreased over the years. Despite the success of the bankruptcy practicum, LAFLA will not be able to continue to host the program in the 2015-2016 term.