Existing Programs and Services

Online Resources

As mentioned in the 2013 report, the Court has added a wide array of resources for self-represented parties visiting the Court’s website and Intake areas. The “Don’t Have an Attorney” page on the Court’s website is a one-stop page providing self-help guidance. It includes information geared toward those who have yet to file and those who have already filed. Both at the window and online, the Court provides petition packets that include instructions and examples for filling out the petition, schedules, and statement of financial affairs. The Court website has long displayed judge-specific information, trustee office locations, FAQ’s for a broad range of bankruptcy questions (in both Spanish and English), links to approved credit counseling agencies and financial management courses, bankruptcy fees, and download ready rules and forms. Additionally, the Court distributes State Bar pamphlets, and other flyers specifically troubleshooting the common problems that arise in cases filed by those without an attorney.

The Court’s “Don’t Have an Attorney” web page serves as a centralized place for self-represented parties to locate information specific to their needs, such as the hours for self-help clinics and seminars offered at each division, and contact information for free or low cost bankruptcy attorneys.

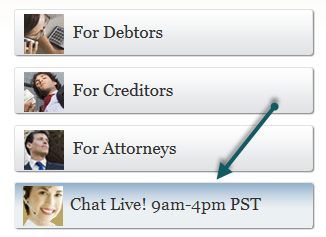

In 2014, the Court began reviewing data to analyze how website visitors accessed this information. Based on its analysis of the website’s Google analytics, the Pro Se Committee began planning a website task force to observe use of the website by self-represented debtors visiting the Court’s self-help desks. This task force will analyze how the web page is currently used in order to update the location of information so that the links used more frequently, such as the “For Debtors” link, will access the most informative web page on that topic in the future.

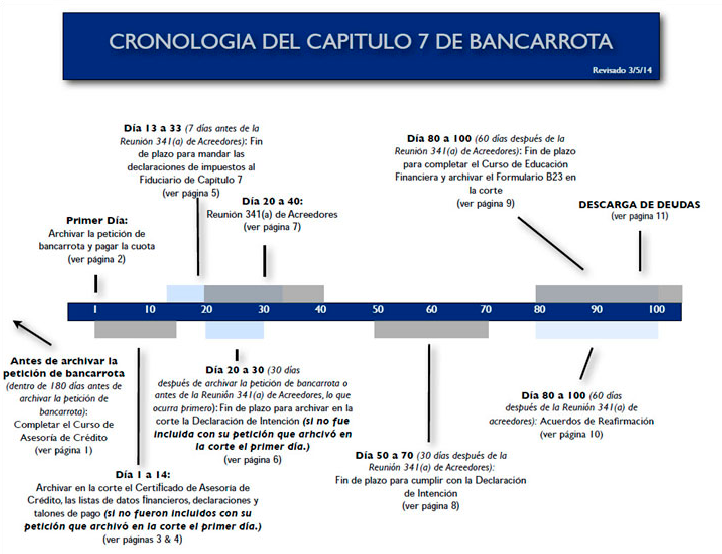

Spanish Timeline

In 2014, the Court expanded its interactive, virtual timeline of chapter 7 bankruptcy with a version translated into Spanish. Viewable on the “Don’t Have An Attorney” web page, the timeline visually represents a typical sequence of events for chapter 7 bankruptcy -- beginning with the pre-filing credit counseling course, and ending with the bankruptcy discharge. Debtors can click on each event in the timeline to find more information on specific requirements, deadlines, and links to useful resources. The timeline gives debtors critical information in manageable segments focused on the aspect of the bankruptcy case they need.

Online Chat

The Court’s Online Chat was developed in 2013 to make it easier for court users to find answers to their procedural questions. In its initial phase, the chat feature was only available to filers using CM/ECF, which is largely used by attorneys. This included online instant messaging with a Court representative to answer case-specific questions and obtain links to frequently requested forms, motions, and orders.

In 2014, the Court’s online chat was made available to all visitors surfing the Court’s website and to self-represented litigants through the Court’s “Don’t Have an Attorney” web page. Approximately 1,730 chats came in from the Court’s website in 2014 (excluding January when the chat feature was not yet available on the website).

A review of quarterly chat reports showed the number of chats received from the general public is generally two to three times higher than chat requests from CM/ECF users. However, chat requests from the website may also include attorneys in addition to creditors and debtors. Chat users are not restricted from using the general public access to chat and are not required to identify themselves, so the Court is unable to track the type of chat user making the request.

Common questions received concern the location of 341(a) meetings and continuance dates; the status of orders and motions, reaffirmations, audio/transcript requests and the amount of fees; general questions regarding discharge, closings, and dismissals; and general case information about credit counseling courses, as well as how to obtain copies and certifications. Also, Court representatives have anecdotally mentioned that they frequently receive inquiries from self-represented parties as to where they may electronically file documents.

While self-represented parties may not file documents through CM/ECF, the eSR software featured in the next section may provide some additional convenience to self-represented parties. Both eSR and chat may be especially helpful to parties in remote locations and disabled parties who have difficulty visiting our onsite self-help desks detailed later in this report. Online chat is available Monday through Friday from 9:00 a.m. to 4:00 p.m., excluding federal holidays and other published Court closures.

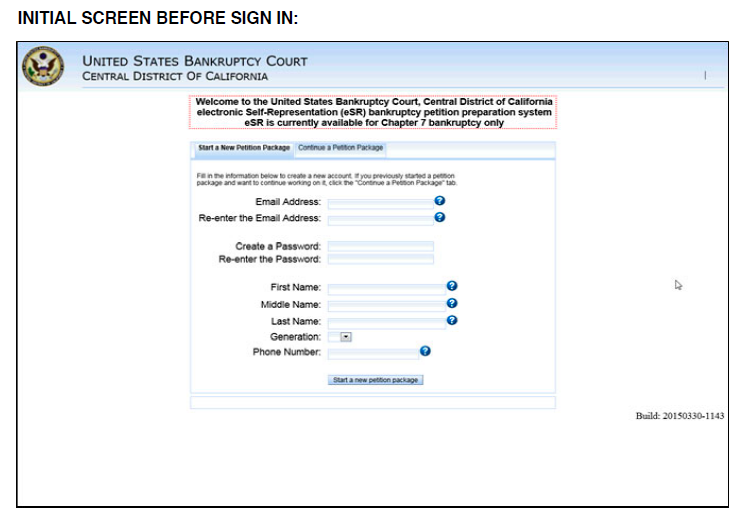

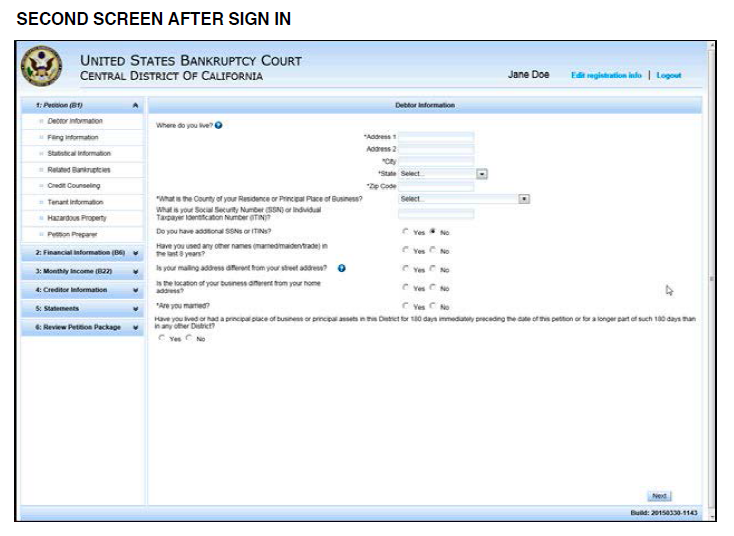

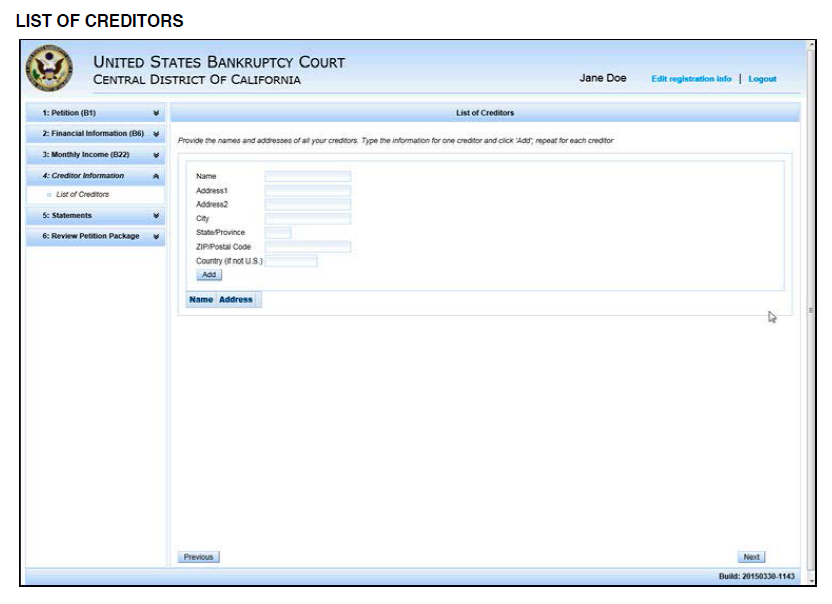

eSR and Self-Help Resource Center

On March 31, 2014, the Central District of California became the first of three test courts to install the electronic Self-Representation (eSR) software successfully in the live environment. eSR is an online tool to help individuals prepare a chapter 7 bankruptcy petition when they have decided to file bankruptcy without an attorney. Judge Maureen A. Tighe has led the Court’s participation over the past several years in developing this tool as part of a national pathfinder initiated by the Administrative Office of the United States Courts.

Initially, eSR was only available at the Los Angeles Division. Debtors were screened for moderate typing skills, literacy in English, and to determine if they were preparing a chapter 7 consumer debt filing that was non-emergency. Screening was completed by Public Counsel after attending a chapter 7 bankruptcy seminar held twice a month at Public Counsel’s office. A similar collaboration was established with Public Service Law Corporation at the Riverside self-help clinic.

The Los Angeles Division had its first official eSR debtor file for bankruptcy on April 16, 2014, making the Court the first in the nation to have an eSR filing. District-wide, intake staff was trained on how the eSR software works and on case processing. Additionally, attorneys volunteering in the self-help clinics also received an overview of eSR and case processing in order to be equipped to answer questions from those using the eSR software to prepare petitions.

All divisions now have at least one computer dedicated for the public to use eSR for preparing their filings and one computer to use as a resource to research bankruptcy information or to find credit and financial management courses. The Los Angeles and Riverside divisions’ self-help desks received valuable suggestions from the staff and eSR debtors during this period. Many users suggested expanding the software’s help feature and adding edit functionality to modify information already entered throughout the module.

After integrating suggestions from initial software users, on Wednesday, September 24, the Court soft-launched the eSR software on the Internet for general access by the public – a major milestone in the project. The software is accessible via the eSR homepage located on the Court’s website at http://www.cacb.uscourts.gov/esr. In addition to a link to eSR, the homepage has eSR frequently asked questions, links to additional forms to be completed and filed with an eSR petition, and also an electronic bankruptcy petition checklist to assist debtors with gathering all the required documents before getting started on a petition. The first two debtors who used eSR to submit and subsequently file for chapter 7 bankruptcy successfully received their discharge in 2014. There were a total of 15 eSR filings in 2014. This is a significant step forward in making the Court fully accessible electronically to self-represented users.

Survey Results

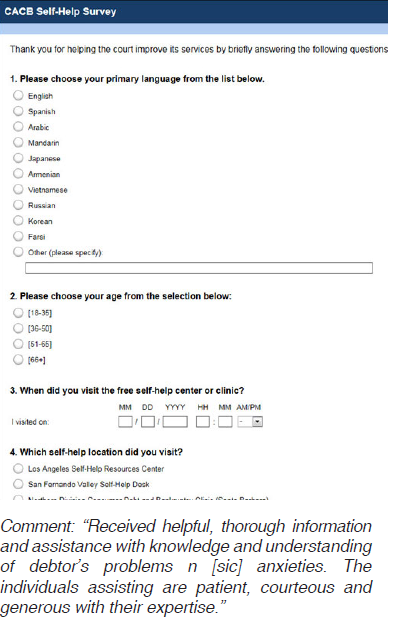

In the Spring of 2014, the Court began distributing a self-help flyer with a QR code to link to a new survey and self-help resources. The survey examines the demographics and experience of those using the Court’s self-help resources. Survey responses have been overwhelmingly positive regarding the services provided on the Court’s website, as well as the services provided by Court staff and self-help desk representatives.

Survey participants were largely in the age range of 51-65; and most listed English as their primary language. Every survey participant listed the wait time to receive guidance with an attorney volunteer was as at least “good.” Many survey participants visited a self-help desk and said they would visit the self-help desk and bankruptcy court website in the future. Many survey participants also mentioned that medical bills/health, job loss/unemployment, or credit card debt led them to file bankruptcy. An example of comments received is shown on the next page. We continue to seek new avenues for feedback from self-represented parties so that we can assist them in obtaining advice of counsel for the information they need.